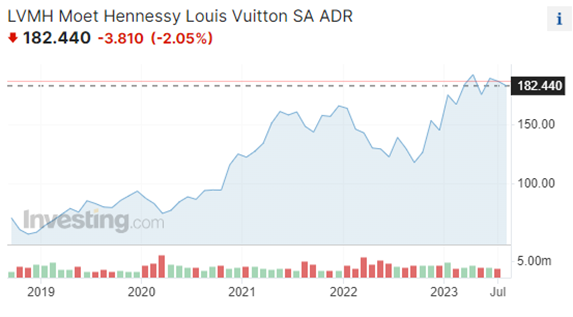

Movement of Louis Vuitton’s stocks in the last five years. (Source: Investing) *

However, today when I was scrolling news on Reuters, I found an article about Hugo Boss going strong. I didn’t think twice before I decided to check what it is about.

Mentioned article on Reuters said that Hugo Boss has raised its sales and profit projections after experiencing a 20% surge in second-quarter revenues, driven by successful brand revitalization and marketing efforts that helped the German fashion house overcome sluggish demand in the U.S. and China. Despite slower-than-expected recovery in China, Hugo Boss achieved a remarkable 56% increase in currency-adjusted sales in the region. While luxury goods companies faced concerns over China's post-pandemic rebound, Hugo Boss managed to perform well, especially in the EMEA and Americas regions, benefitting from a rise in tourism.

Very good news for them. Managing to sell more than projected, despite the major setbacks of different factors is a great achievement. But the news did not end there. The company opened 17 new Boss stores, with a focus on six in Asia, and expressed plans to launch its first larger store in Guangzhou in the fourth quarter. While the market expected a guidance increase, higher working capital might be viewed sceptically given the retailer's inventory challenges. Hugo Boss aims to gradually normalize its inventories in the second half and bring down stocks to less than 20% of group sales by 2025.[1]

Since I was very impressed by the fundamental analysis, I was not as impressed by the technical part. Company’s stocks have suffered a correction in the past five years, which started with the beginning of Covid, so it makes sense. After that, however, stocks have managed to climb back on even higher point than the pre-pandemic price – to the current price of 72,42€.* The highest point of their price was in 2015, when the price was 110€ per stock *, which means that if company will continue with delivering good news, I am expecting them to eventually reach that price again, or even break it.[2] But, as with all things, I will have to be patient and follow the movement of their stocks.

Movement of Hugo Boss’s stocks in the last five years. (Source: Investing) *

* Past performance is no guarantee of future results.

[1,2] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.