Quick search over the Investing page offered me three articles, all of which were reporting about the surprise decision from OPEC to cut the production. It immediately made sense, because now markets will face the typical scenario of low supply and big or same demand, which in theory should put the prices up. The articles stated that unexpected reductions in OPEC+ group's output targets could cause oil prices to surge towards $100 per barrel, leading to a potential clash with the West dealing with higher interest rates. Despite pressure from Washington to cut ties with Moscow, the decision highlights the solidarity within OPEC+ while also hindering the West's efforts to limit Russia's oil revenue. Following the announcement of further production target cuts of approximately 1.16 million barrels per day from May through the end of the year, oil prices rose over 6% on Monday. * Not very bright news to us consumers, however, great news for traders. Calculations suggest that these commitments will bring the group's total volume of cuts since November to 3.66 million bpd, equivalent to 3.7% of global demand. Although OPEC+ was expected to maintain output levels this year after a 2 million bpd reduction in November 2022, this latest move suggests otherwise.

The other two articles confirmed the same as the first one was mentioning, adding that while the decision is bullish for the market, OPEC+ will need to consider how the cut will be perceived as it could indicate concerns about the current economic environment's demand outlook. Goldman Sachs raised its Brent oil forecast to $95 a barrel for December this year from $90 earlier, and to $100 for December 2024 from $95. [1]

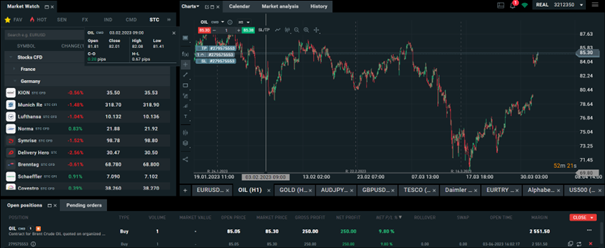

I thought to myself, shame that I missed this nice opportunity, however, I still decided to enter the trade on bullish hopes. The current price of oil is at $85 per barrel, which means that if the price will go to the predicted one by Goldman Sachs, it will create me a nice profit.

*

* Past performance is no guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.

Link to a 5-year chart: https://www.investing.com/commodities/brent-oil