First article was aimed at interest rate hike in USA in May this year. It said that investors are cautious when trading with anything connected with US dollar or US stocks or/and indices. It makes a lot of sense, as I am approaching these markets with caution also. Every time when there were interest rates hikes, or something was happening in US bank, markets were volatile and unpredictable. Especially instruments tied to them, as mentioned before.

Second article was aimed at CPI data later this week in USA. It is expected, that reported numbers will be worse than expected, which means bad news for USD, and anything related to it. In the same article was written that Bitcoin and gold are expected to rise in case that USD will lose value.[1] Again, article that makes much sense and has logic behind it. It should be like this, at least in theory. But to confirm that theory, I will have to wait until the end of the week and to May. Based on the information gathered from both articles, I decided to check the S&P 500 chart. I decided for index because it has almost nothing to do with Euro or other big currencies.

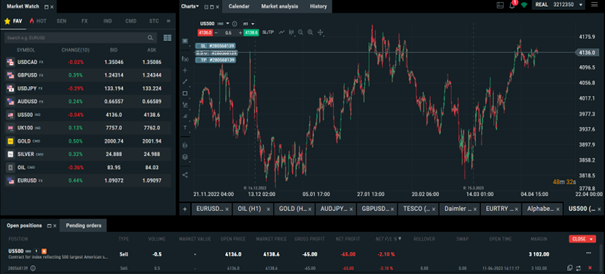

From the technical perspective, mentioned index is trading sideways for the last week. Its price was moving between 4170 and 4100 USD.* Before that, however, index saw a big rise from around 3800 USD.* But, again, when I checked longer term, index was constantly trading between 4170 and 3800 USD for at least 6 months.* If history of its movement will repeat, I am expecting the price to fall.[2] Also based on the fundamental analysis from those two articles, this is the most logical decision to do. I decided to open a trade on short, however, with a lot of caution. And I will monitor the movements and act accordingly. This trade is meant to be longer term, and not a daily trade. If I would decide for a daily trade, I would go with long position, as also indicators on Investing are suggesting buying, or even strong buy in some time frames.

*

* Past performance is no guarantee of future results.

[1,2] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.

Link to a 5-year chart: https://www.investing.com/indices/us-spx-500-chart