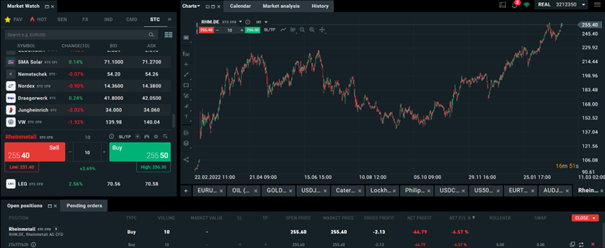

Rheinmetall’s stocks have experienced enormous growth in the last year, since the start of invasion of Ukraine. Right before the attack, the price of a stock was at around 94 euros. Today, the price of one Rheinmetall’s stock is 255.70 euros. Quick math, almost 300% growth in just one year. And given the demand for weapons by Ukraine, and of course other countries, I don’t see the growth in their price slowing down or falling. Quite opposite, the bigger the demand will be, more I expect the price of it to grow. But I thought to myself that I will approach the trade with caution, as the price is currently at their highest in history. In fact, at only 2 occasions in 2018 the value of stock broke the barrier of 100 euros, however, before and after that the price was always below. So, as good as it sounds that the price is constantly rising, this can take an opposite turn quite quickly. After checking the chart, I went to check the article more detailed.

The article said that German defence contractor Rheinmetall is in talks to build a tank factory in Ukraine. The factory, which could be set up for around €200m, could produce up to 400 of Rheinmetall's latest battle tanks models, the Panthers. Ukraine currently lacks the equipment to fully retake its territory and requires around 600 to 800 tanks. Rheinmetall produces the Leopard tanks that Germany has sent to Ukraine. The company will join Germany's DAX index this month due to increased defence spending resulting from the war in Ukraine. Now this is very important information for any investor. Company joining one of the strongest indices in the world? For sure a good signal. After considering all the gathered information, I have decided to open position on long, however, will keep an eye on it.

*

* Past performance is no guarantee of future results.

Link to 5 year chart: https://www.investing.com/equities/rheinmetall