GBP/AUD

Fundamental analysis provides key information but is insufficient on its own to form a trading decision. This is where technical analysis comes in, helping me to complete the analysis of the underlying asset to the point of placing a specific trade. With the BoE currently advocating a strong hawkish policy, the pound is gaining strength. * GBP/AUD was the market that met the criteria for trade entry to the highest level of all pairs containing the pound.

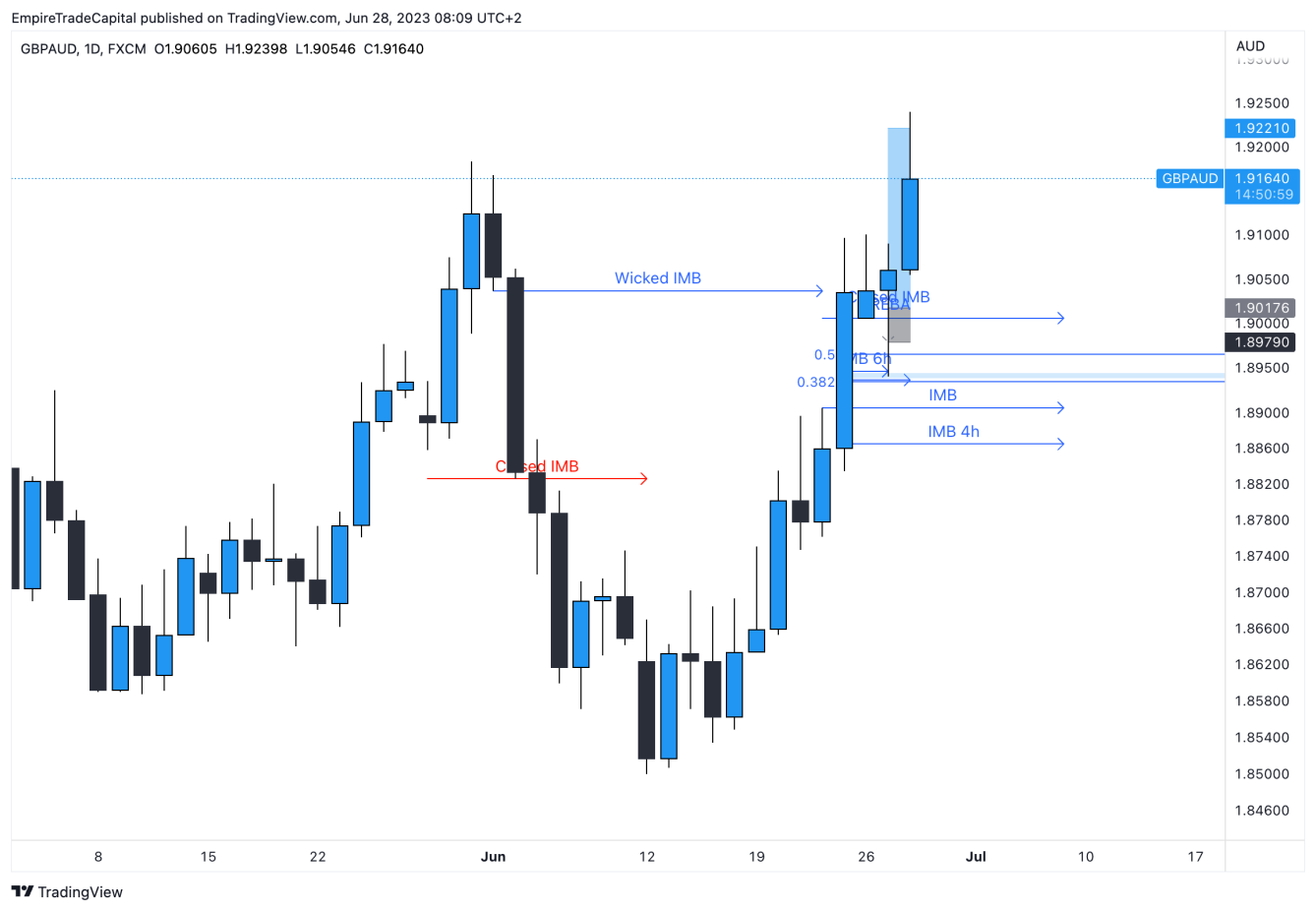

Weekly/Daily timeframe

In terms of the weekly timeframe (TF,) I saw a strong bullish candle - the so-called Morning Star candle formation, which closed the bearish Imbalance zone. This became the trend continued in an uptrend. *

The daily timeframe also showed positive signals to enter a buy position. The price filled the daily Imbalance Zone and did not start to create any Bearish Momentum. This convinced me that this market is bullish. *

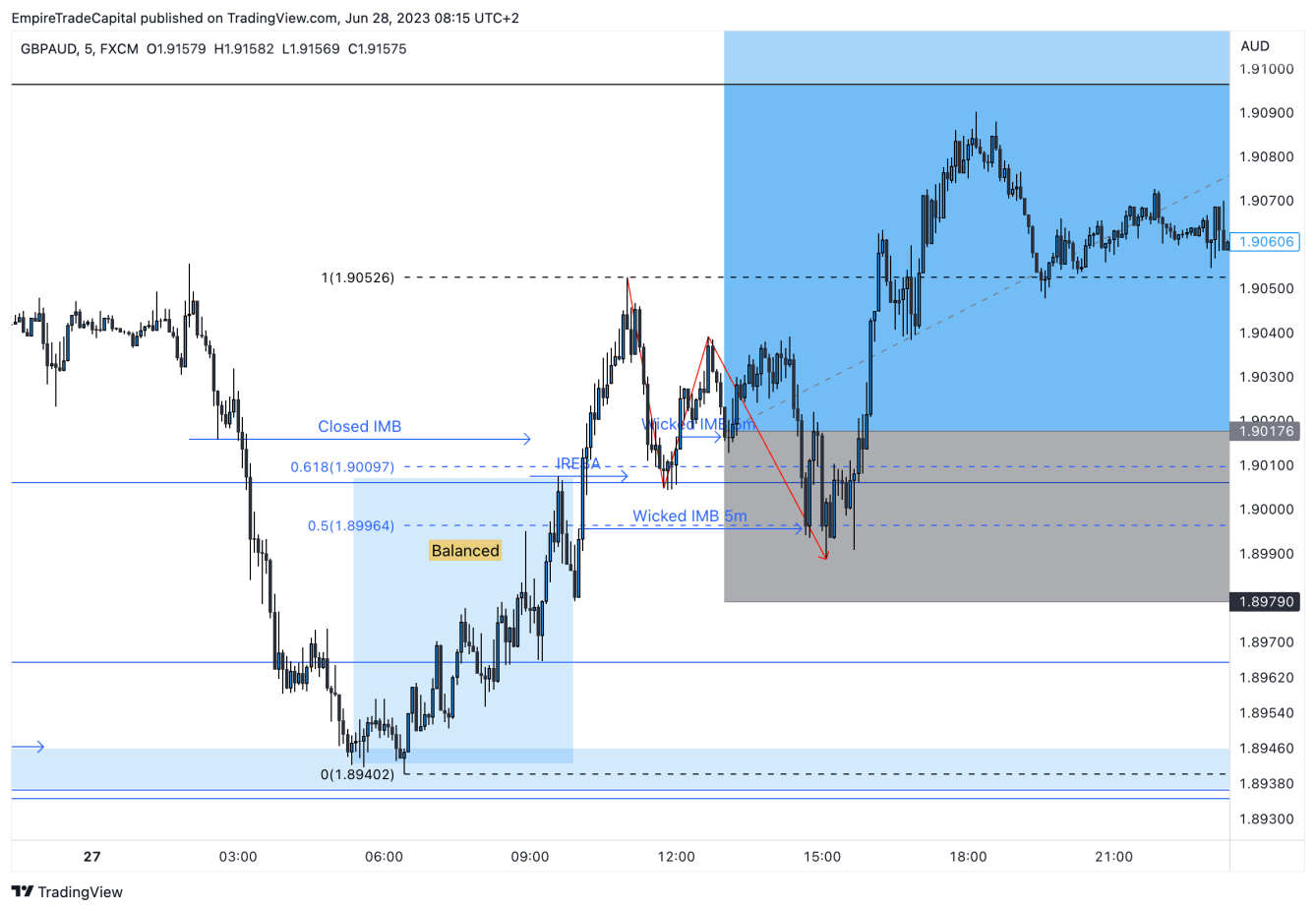

On the day of the trade entry, the price on the Daily TF fell to the Golden zone - 0.5/0.382 Fibonacci retracement zone and then impulsively returned. * This movement is better seen on the lower TF.

Trade entry

After the price retraced, I was just waiting for the right moment. On the one-hour TF, the price closed the bearish Imbalance zone, only testing the bullish one. On the 5-minute TF, I saw that the moves were completely balanced except for one, so I entered the trade at the market price, at about the 0.5 Fibonacci level. *

I placed the Stop Loss below the Higher Low (HL,) in the balanced zone because the price has no reason to fall there. Take Profit was set very clearly. On the weekly timeframe there are many Equal Highs (EH) above which there is a large amount of liquidity (Stop Loss orders of traders selling at resistance) which the price always targets. *

This trade ended with a profit of 5.27R (Risk Reward Ratio.) *

* Past performance is no guarantee of future results

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

5-year performance: https://www.investing.com/currencies/gbp-aud