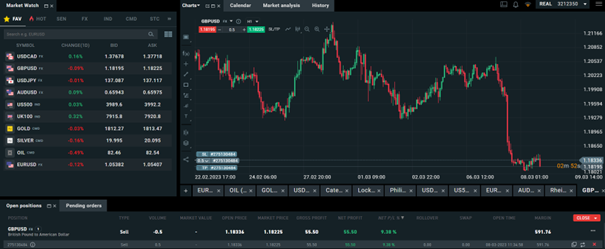

I moved back to the chart, and I couldn’t get past this drop. And interestingly, it stopped in one of the support levels, that bounced the price back also in the beginning of January. But when I moved around with the cursor, the drop was not that explicit as it first seemed, as it was 2,09%. It fell from the point of 1,20625 to the current price at 1,18342. And this is exactly the price where Decembers/Januarys drops stopped and returned. Because the price looks like it can’t decide if it wants to continue with the fall, or it wants to go back up, I thought to myself that it would be smart idea to approach the trade with care. * And of course, I need more information regarding the currencies to make an easier decision.

I continued with the reading of article I have found. The interest rate hike in the UK is still not confirmed, while Jerome Powell made a signal that US will highly likely decide to do so. In theory, or in past it has shown that when given country decided to raise the rates, the value of its currency strengthened. * For me as a person, or daily spender, that is good. But for me as an investor, not so much. Or depends on what I want to invest into.

As everything was very confusing and unclear, I checked the economic calendar for today, as well as what technical indicators on investing say. As for economic events today, USA will release the non-farm employment change data, as well as Powell will testify again. Again, the volatility. But I am expecting positive news. Long term, the indicators say sell, while for very short term (5 minutes chart), indicators say long. And I am here for longer term, so I decided to open a position on short, in expectance of positive news from the US. [1]

*

* Past performance is no guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.

Link to 5 year chart: https://www.investing.com/currencies/gbp-usd