The article said that investors seeking safe-haven assets caused a decrease in government bond yields in the US and Europe on Monday, while considering the potential repercussions of Silicon Valley Bank's collapse and a possible less aggressive tightening from the US Federal Reserve. To address concerns of a broader financial crisis following the failure of SVB, US authorities implemented emergency measures on Sunday to restore confidence in the banking system. The impact of SVB's collapse continued to negatively affect markets worldwide, with bank shares in Europe and Asia dropping sharply, and even large US banks experiencing a pre-market rally before authorities intervened. I was right, many things did in fact happen. I read further and saw that as a result, Goldman Sachs analysts no longer anticipate a rate hike at the US central bank's 22nd of March meeting and note significant uncertainty beyond March due to recent events in the banking sector. The US 2-year Treasury yield fell by 34 basis points to 4.25%, the lowest it has been since 3rd of February. Likewise, Germany's 2-year yield decreased by 40 bps to 2.67%, hitting its lowest level since 9th of February and recording its largest daily drop since January 1995.

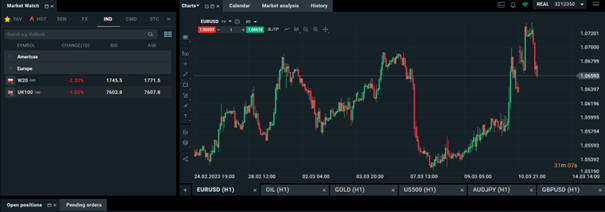

Many things that could influence both of currencies. I reopened the chart of EURUSD and the volatility in the past few days have been remarkable. On 8th of March, the price of this pair was on 1.05276 and then rapidly increased to 1.07351. So, in a span of 2 days a 2% increase. After that, USD seems to find some stability, as the pair fell to current 1.06635.*

It is a hard choice to make for what to open position on. I have decided to go more for the longer term and open a position on long. I expect that the saga with SVB will keep a negative effect on the USD more than on EUR. However, short term trade seems like to be a good opportunity for sell.

* Past performance is no guarantee of future results.

Source to a 5 year chart: https://www.investing.com/currencies/eur-usd