Taiwan Semiconductor Manufacturing Co (TSMC), the world's leading chipmaker, recently updated its 2024 revenue growth forecasts following better-than-expected quarterly results. Given the potential fundamentals arising from this revision, investors have a chance to take advantage of the opportunity to bolster their investment portfolio with a strong player in the technology space.

Financial performance

The most recently released financials reveal a remarkable 36% increase in earnings for the June quarter, which significantly beat market expectations. This sharp increase is mainly attributed to the company's key role in the artificial intelligence sector, where demand for high-performance computers has intensified. For the coming period, TSMC expects revenue growth to exceed the mid-20% range originally projected, with estimated quarterly sales reaching as high as US$23.2 billion. [1]

The capital expenditure forecast has also been refined to a range of US$30 billion to US$32 billion, up from the original low end of US$28 billion. This adjustment signals TSMC's determination to expand its manufacturing capacity in a tightening global supply chain environment.

Market dynamics and strategic moves

Against the backdrop of escalating trade tensions between the U.S. and China, TSMC's optimistic outlook is a testament to the continued demand for AI infrastructure at large technology firms, including Microsoft and Baidu, which rely heavily on Nvidia accelerators, a major product line from TSMC. In addition, the broader smartphone market contributed to the stable financial situation, buoyed by Apple's positive forecasts for shipments of its upcoming iPhone 16 phone.

As stated by CEO C. C. Wei, the strategic expansion is intended to address acute supply constraints that are projected to last until 2025. The company's readiness to expand, meets the growing market need and strengthens its leadership position in the industry.

Investment considerations

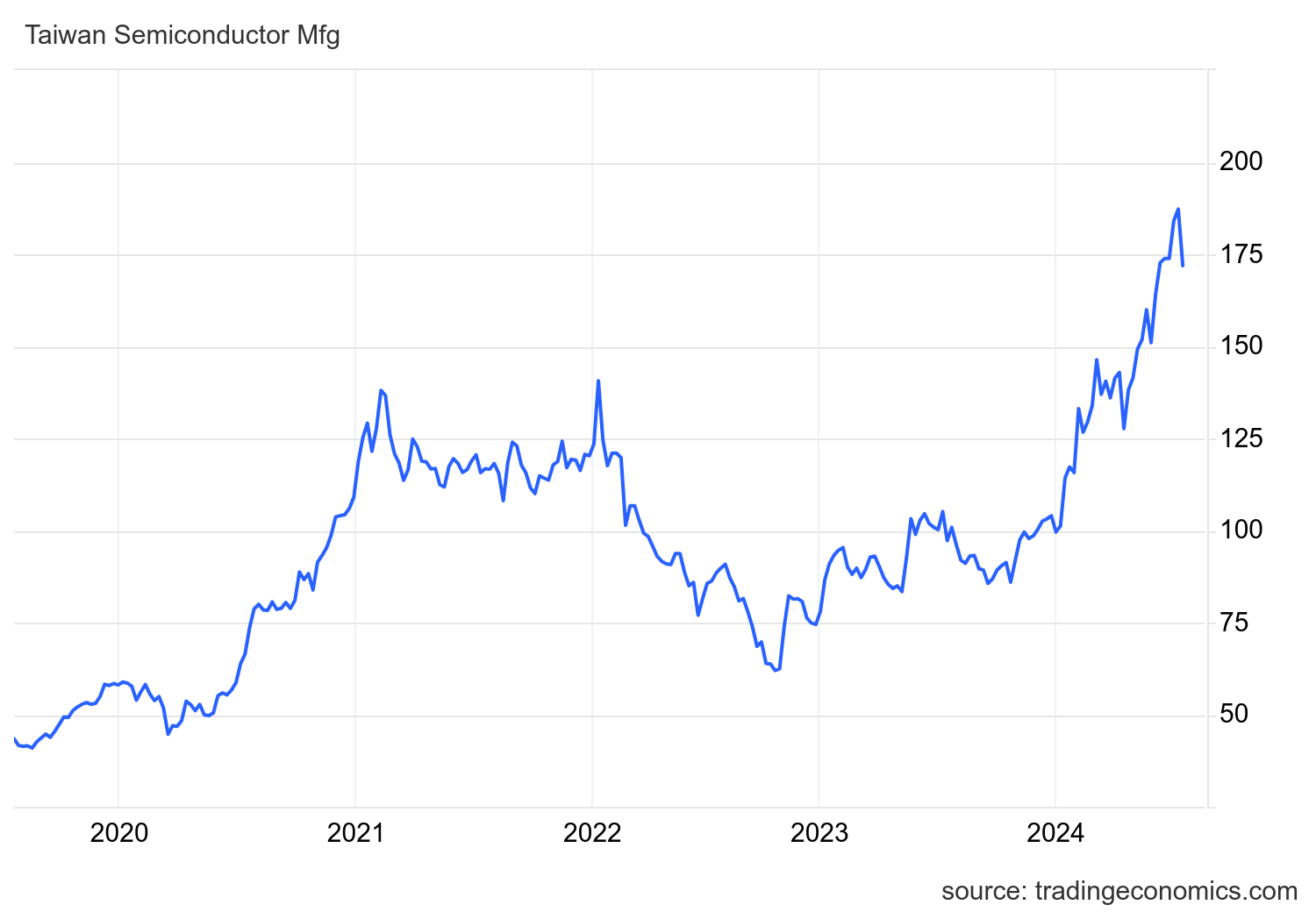

Investors should note the significant rise in the market valuation of the firm, whose shares have more than doubled since the AI boom initiated by OpenAI with the ChatGPT model in late 2022. * Market capitalization briefly crossed the $1 trillion mark. This reflects investor confidence in its growth trajectory and operational expansion. However, potential investors must also consider the associated geopolitical risks, particularly the US-China trade relationship, which could affect TSMC's operations in the Americas.

Evolution of TSMC shares over the past five years

Conclusion

TSMC stands out as an interesting investment opportunity within the semiconductor industry, especially for those looking to take advantage of the exponential growth in artificial intelligence and computing technologies. With strategic capital investments, upwardly revised financial forecasts and a strong position in key technology sectors, the company is thus well positioned to continue its growth trajectory in the face of evolving market challenges and technology demands. [2]

* Past performance is no guarantee of future results

[1,2] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.