In a technology world increasingly driven by artificial intelligence (AI), Apple Inc (NASDAQ:AAPL) stands out not only as a participant, but also as a pioneer. Apple's recent integration of advanced AI features into its devices underscores its strategic alignment with the future of technology, which is focused on enhancing user experience and operational efficiency. Apple's initiative to minimize latency through "hardwired" connections in iPhones for real-time AI interactions represents a significant advancement in edge computing that promises to streamline data processing and increase responsiveness.

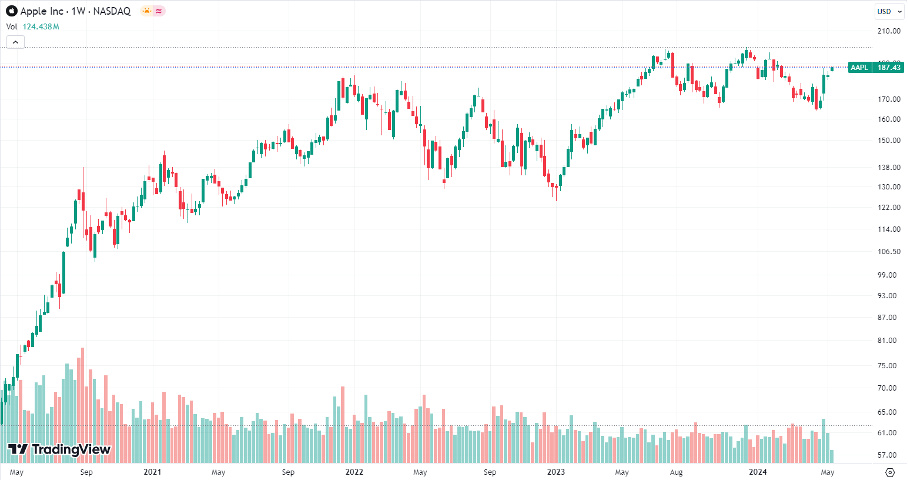

Apple Inc. stock performance over 5 years. Source: tradingview.com*

Market sentiment and financial forecasts

The enthusiasm of financial analysts, including Bank of America's reiterated BUY rating, reflects the broader market's confidence in the company's trajectory. Highlighted is the potential improvement in gross margin and momentum in the services sector, supported by its innovative AI integrations. Such advances not only meet the growing demand for smart technologies, but also consolidate a competitive advantage in a relatively crowded market.

Collaboration with OpenAI and wider impact on the industry

The collaboration and technological advances demonstrated by OpenAI, particularly with the launch of GPT-4o, reveal the dynamic potential of AI. Apple's approach to incorporating these advances into its ecosystem, prioritising both functionality and user privacy, demonstrates a long-term commitment to delivering cutting-edge technology while protecting customer data. This strategy not only increases investor confidence, but also positions Apple favorably against its competitors. [1]

Investor Insights: Why Apple deserves attention

For marketers and investors, Apple's proactive AI strategy, coupled with its strong financial outlook, presents a lucrative opportunity. The tech giant's ability to seamlessly integrate cutting-edge technology into consumer-friendly products ensures sustained interest and demand, which drives revenue growth and increases shareholder value. In addition, the strategic focus on AI and its potential for scalability across different market segments suggest a promising avenue for long-term investment.

Focusing on future challenges and opportunities

Despite potential challenges such as market saturation and the high cost of technological innovation, a consistent track record of weathering market fluctuations and strategic investment in AI technology is a reassuring sign of stability and growth potential. For investors looking to profit from technological developments, Apple stock would be an attractive addition to a portfolio given its strategic market position and future growth potential. 2

Conclusion

As artificial intelligence continues to redefine the technology landscape, Apple's commitment to innovation and market leadership makes it an exceptional investment opportunity. With strategic expansion and collaboration poised to enter new consumer segments and technological frontiers, this company not only holds the promise of growth and profitability, but also offers a gateway to participate in the future of technology. For savvy investors, closely following Apple's path in AI could also yield significant dividends in the evolving world of technology. [3]

* Past performance is no guarantee of future results.

[1,2,3] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.