Credit Warning from Moody's

In a recent development that has raised eyebrows in the global financial community, Moody's, a leading credit ratings agency, has warned about the mounting risks from China's burgeoning debt pile. Amidst an economic slowdown and a deepening property crisis, Moody's has downgraded its outlook on the Chinese government's debt from stable to negative. This move underscores growing concerns about the challenges facing the world's second-largest economy.

A Confluence of Economic Strains

China is currently at a crucial juncture, grappling with multiple economic pressures. Soaring youth unemployment, a weakening global demand impacting its manufacturing sector, and escalating problems in the property sector are some key issues. The situation is exacerbated by some of the country's largest construction companies facing insolvency, halting building projects and leaving customers in limbo. Additionally, local governments, heavily indebted from infrastructure projects and reliant on land sales for revenue, are under significant strain.

Fiscal and Economic Implications

It is important to point out that the expected support for local governments and SOEs poses broad risks to China's fiscal, economic, and institutional strength. Absorbing even a portion of these liabilities could entail material costs, potentially undermining China's fiscal robustness and creditworthiness. This scenario is worrying not just for China but for the global economy at large, given the country's significant economic footprint.

The Negative Outlook and Its Consequences

The negative outlook from Moody's is a precursor that could lead to a downgrade of China's credit rating. Such a rating is crucial as it helps investors assess risks associated with investing in bonds and other debt instruments and influences how lenders set interest rates. While Moody’s has maintained China’s A1 rating for its long-term national debt, the downgrade in outlook signals caution.

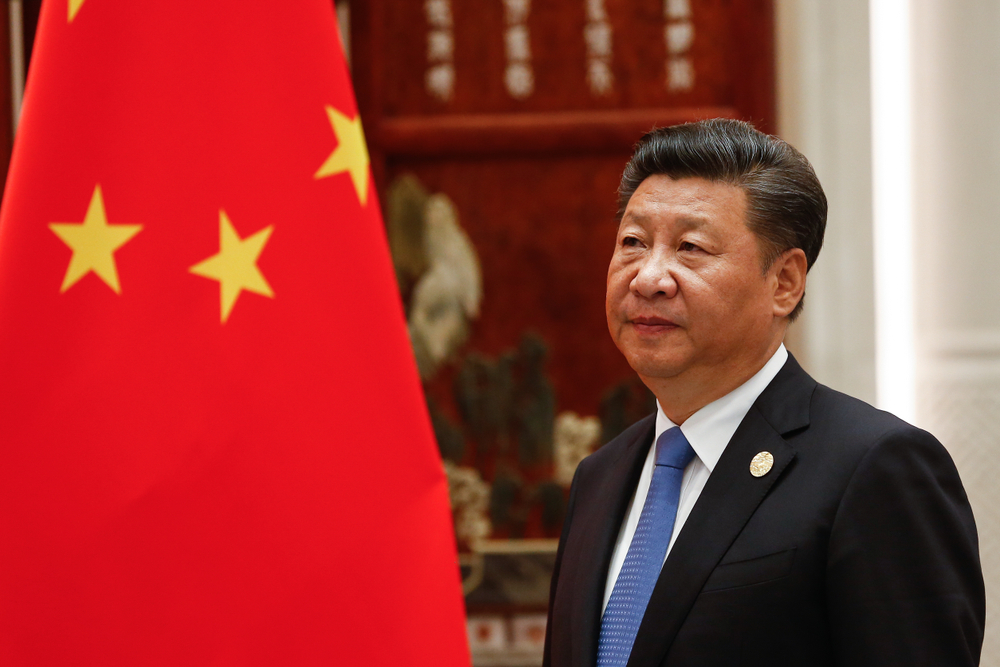

China's Response and Future Prospects

Responding to Moody's move, China’s finance ministry expressed confidence in the country's long-term economic prospects and its ability to manage the impact of the property sector slowdown. The ministry emphasizes China's ongoing recovery and advancement in high-quality development. Despite these assurances, international economic groups, including the International Monetary Fund, have warned that China's economic deceleration, expected to slow to 3.5% by 2028, could have a ripple effect on the global economy.

Conclusion

As China navigates through these turbulent economic waters, the path ahead seems fraught with challenges. The country's efforts to ramp up stimulus spending and its commitment to an orderly management of economic challenges are crucial steps. However, the implications of China's economic slowdown extend beyond its borders, particularly in regions heavily invested in by China, such as sub-Saharan Africa. Investors and policymakers worldwide will closely monitor China's manoeuvres in addressing its debt crisis and economic slowdown, given their potential global impact.