Ford consolidates its market position

Ford Motor Company, the traditional giant in the automotive industry, has announced a significant shift in its strategy that signals a new era for the company and its shareholders. Following the recent release of financial results for the quarter that beat analyst estimates thanks to innovations in artificial intelligence, Ford saw its shares rise 6.1% in after-hours trading. * This growth was boosted by the announcement of an 18-cent per share dividend increase in the first quarter, a move that follows a similar decision by rival General Motors.

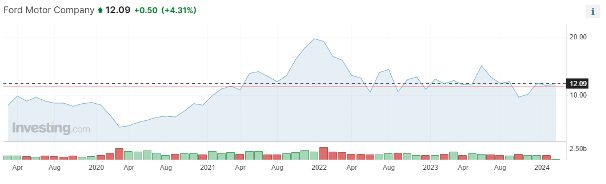

Source: investing.com*

A cautious approach to electric vehicles

Despite optimism in AI and cloud services, Ford is facing challenges in its Model E electric vehicle division, which posted a loss of more than $47,000 per vehicle in the most recent quarter. This situation has caused the company to reduce investment in its new EV line-up to match the slower demand for their electric vehicles. Marin Gjaja, the head of the Model E division, stressed that Ford's new generation EV will only be launched if it can be profitable.

Strategic investments and profitability

Ford is focusing on increasing its profitability and cash flow through its Ford Pro business division and Ford Blue combustion vehicle unit to offset losses from EV operations. The company forecasts free cash flow in the range of $6 billion to $7 billion for this year and has committed to returning 40% to 50% of that cash flow to investors.1 This approach emphasizes a commitment to rewarding its shareholders and maintaining consistency in pay-outs.

Ford's future in an era of electrification

Ford's response to the slower adoption of electric vehicles by the mainstream and the price war launched by Tesla brings an important change in strategy. The company plans to invest in larger EVs, such as trucks and vans, while increasing its commitment to hybrids, which offer higher profit margins. This highlights the carmaker's struggle to strike a balance between innovation and financial sustainability in this uncertain market environment.

Conclusion

Given the current market challenges and rapid developments in electric vehicles, Ford is focused on strategically adapting to the changing environment. This transition reflects a commitment to innovation while maintaining a solid foundation of financial stability and shareholder value. Looking to the future, Ford is not afraid to take the necessary steps to secure its position as a leader in the electrification era, while emphasizing the profitability and sustainability of its business operations. Ford's path forward demonstrates a balanced approach to growth and innovation that could serve as a model for the entire automotive industry.

* Past performance is no guarantee of future results

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.