Many pharmaceutical companies made nice profit or even a fortune during the Covid pandemic. However, now that pandemic is relatively over, they will have to find a new way to earn money, since Covid vaccines will not be selling as much as they did. And these companies proved, that they already have plans for future development, so let’s check what they are up to.

Novo Nordisk and Pfizer’s weight-loss pills

Novo Nordisk and Pfizer have released data demonstrating the effectiveness of oral weight loss drugs in the same class as Novo's popular Wegovy injection. Novo Nordisk's late-stage trial showed that an oral version of semaglutide produced weight loss results comparable to the injected Wegovy, while Pfizer's mid-stage trial showed that its oral compound resulted in weight loss like Novo's injected Ozempic. The demand for weight loss treatments like Wegovy is substantial, with potential sales reaching up to 100 billion USD within a decade. [1]

Novo Nordisk plans to file for approval of its daily tablet this year, while Pfizer anticipates gaining a significant share of the growing market. The choice between oral pills and injections could expand the total market as some physicians may prefer prescribing pills. Novo Nordisk's pill has shown statistically significant weight loss and is expected to be launched pending portfolio priorities and manufacturing capacity. However, Novo Nordisk has faced supply challenges in meeting the high demand for Wegovy, with a focus on prioritizing the U.S. market.

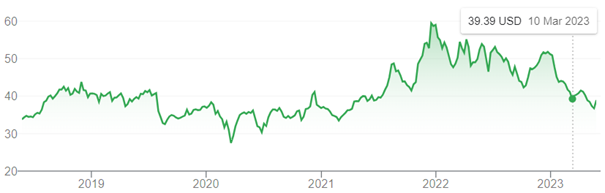

Movement of Novo Nordisk stocks in the last five years. (Source: Google Finance) *

FDA backed Pfizer’s RSV vaccine

Advisers to the U.S. Food and Drug Administration (FDA) have expressed support for the safety and effectiveness of Pfizer's experimental vaccine for respiratory syncytial virus (RSV). The advisory committee unanimously agreed that the available data demonstrated the vaccine's efficacy in administering it to pregnant women in their second or third trimesters to prevent lower respiratory tract infection and severe disease in infants up to 6 months old. Additionally, the expert panel voted 10-4 in favour of the vaccine's safety for this patient population, indicating a positive path towards potential approval in the United States.

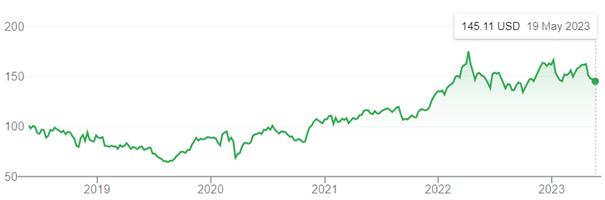

Movement of Pfizer stocks in the last five years. (Source: Google Finance) *

FDA approved Genmab-AbbVie’s blood cancer therapy

Another one or two on the list that got green light for their therapy are Genmab and AbbVie. The approval came from FDA for the treatment of adult patients with advanced large B-cell lymphoma who have undergone at least two prior lines of treatment. Sold under the brand name Epkinly, this therapy is the first of its kind to be approved by the FDA for this specific disease, which affects approximately 150,000 people globally each year. The FDA is currently reviewing another drug, glofitamab by Roche, as a potential treatment for the same patient group. Epkinly has a list price of 37,500 USD per month, with the average monthly cost expected to decrease after nine months due to reduced dosing frequency. This approval provides AbbVie with an expanded product pipeline as it faces increased competition for its flagship arthritis drug, Humira.

Movement of AbbVie stocks in the last five years. (Source: Google Finance) *

Conclusion

It seems that all four companies that we mentioned, have good and solid plans. And not only that, but they also already have green light for many of their drugs, meaning, that their future is bright. At least from the looks of it now.

* Past performance is no guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.