Super Micro Computer Inc. (NASDAQ: SMCI) today announced its preliminary financial results and forecasts, which brought mixed reactions to the market. On the one hand, the company expects significant revenue growth by fiscal 2026, expecting $40 billion, which is more than 30% more than analysts expected. On the other hand, short-term results are falling short of expectations, and the company also has to deal with regulatory issues that could affect its future on the Nasdaq.

Short-term results below expectations

Although long-term forecasts look promising, the expected financial results for the fiscal second quarter of 2025, ending December 31, 2024, are lower than the market had anticipated. Expected revenue was between $5.6-$5.7 billion, while analysts were expecting $5.81 billion. Adjusted earnings per share (EPS) are likely to reach 59 cents, which is 5 cents less than Wall Street analysts had predicted.

In addition, Super Micro also lowered its revenue outlook for the full fiscal year 2025 to $24.3 billion, while the previous forecast was $28 billion. This review suggests that the company may face short-term challenges, which are mainly related to product delivery delays and the complexity of AI server production.

Stock growth and market expectations

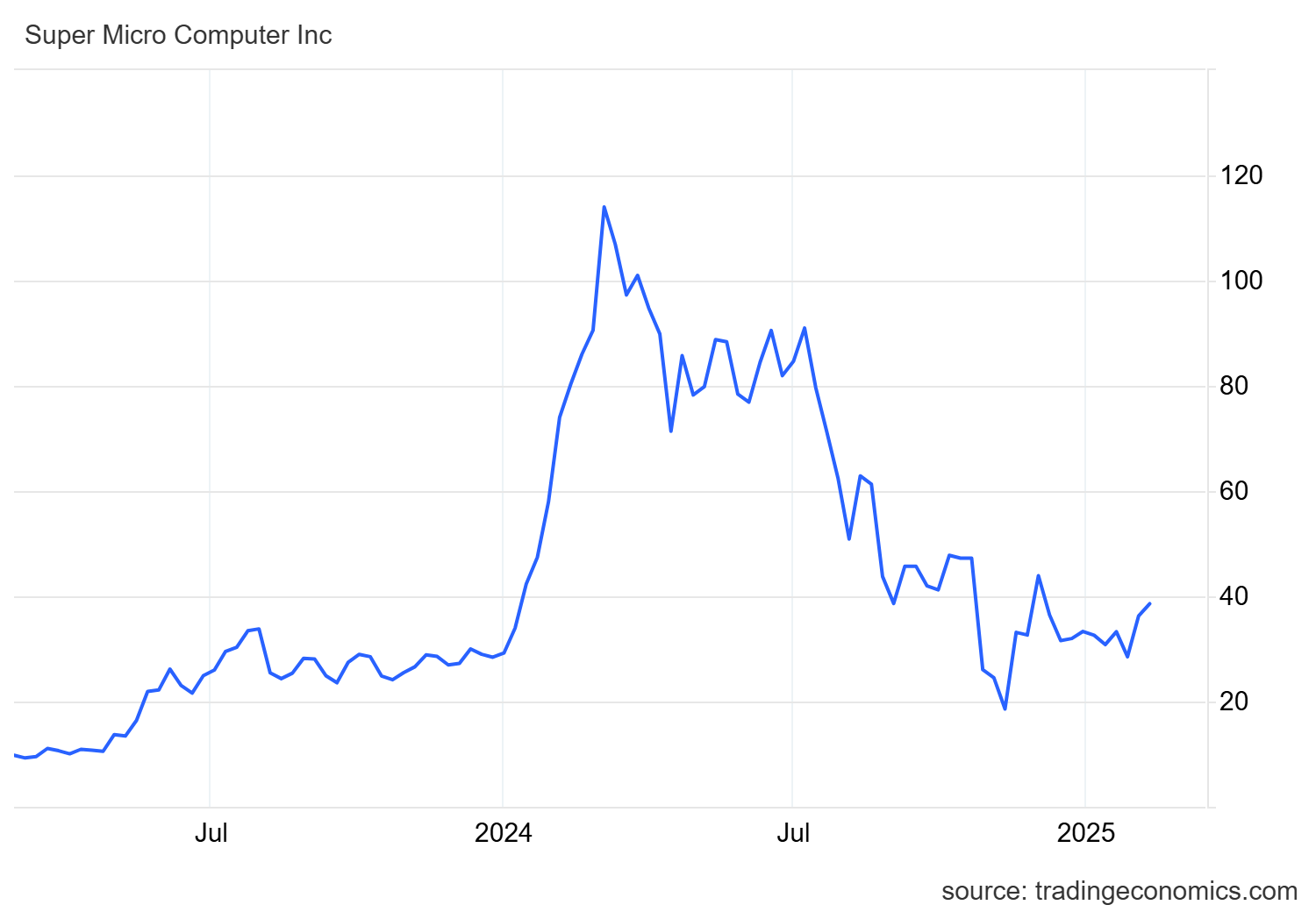

Despite these short-term concerns, following the announcement of forecasts, Super Micro shares are up 8% in extended trading.* They have gained 25% since the beginning of 2025, suggesting that investors perceive the company's potential for AI infrastructure largely in the long term. *

Super Micro Computers Inc. share price performance over the past five years*

The demand for powerful AI servers continues to grow, which is a positive signal for Super Micro. Products using Nvidia's new Blackwell B200 chips are already in full production, reinforcing expectations that the AI infrastructure market will expand in the coming years.

Nasdaq Delisting Risk and Legal Issues

The biggest uncertainty remains the risk of delisting from the Nasdaq stock exchange. The company has still not provided the necessary financial statements, which has led Nasdaq to extend the deadline for their delivery to February 25, 2025. This problem was exacerbated after the auditing firm Ernst & Young LLP resigned in October 2024 due to governance and transparency concerns.

The situation is also complicated by an ongoing investigation by the US Department of Justice and the Securities and Exchange Commission (SEC). The investigation was prompted by allegations by Hindenburg Research, which questioned some of the company's accounting practices. However, Super Micro says it is working with authorities and working to publish the reports in a timely manner.

While an independent audit in December 2024 found no evidence of misconduct, the company replaced its chief financial officer (CFO) and other top executives in response.

Long-term outlook: Is it worth investing in Super Micro?

Despite the short-term challenges, the Super Micro seems well positioned for long-term growth. The revenue forecast of $40 billion in 2026 is a strong signal for investors who are focused on the expansion of AI infrastructure. The company will need to resolve its regulatory issues and restore investor confidence, but if it succeeds, it can maintain the upward trend and strengthen its position in the AI server market.

* Past performance is not a guarantee of future results

Resources:

https://s204.q4cdn.com/707617056/files/doc_financials/2025/q2/SMCI-Q2FY25-Press-Release.pdf

https://finance.yahoo.com/news/super-micro-gains-long-term-225915283.html