2023 was a pivotal year for technology stocks, with the Nasdaq Composite soaring to an all-time high, driven largely by the burgeoning field of artificial intelligence (AI). As we turn the page to 2024, the focus is sharply on the "Magnificent Seven" tech giants, with Amazon (NASDAQ: AMZN) taking centre stage. The question on every investor's mind: is this the right time to capitalize on Amazon's stock, or is there more room to grow?

Analysing the Nasdaq's Historical Resilience

Understanding the Nasdaq's historical performance is key to forecasting its trajectory. Remarkably, since its inception, the Nasdaq has mostly rebounded following a downturn. The trends indicate that after significant drops, the index has not only recovered but has often soared to new heights in the subsequent years. 2023's remarkable 43% rise, following a 30% drop in 2022, aligns with this pattern, hinting at the potential for continued growth in 2024. * [1]

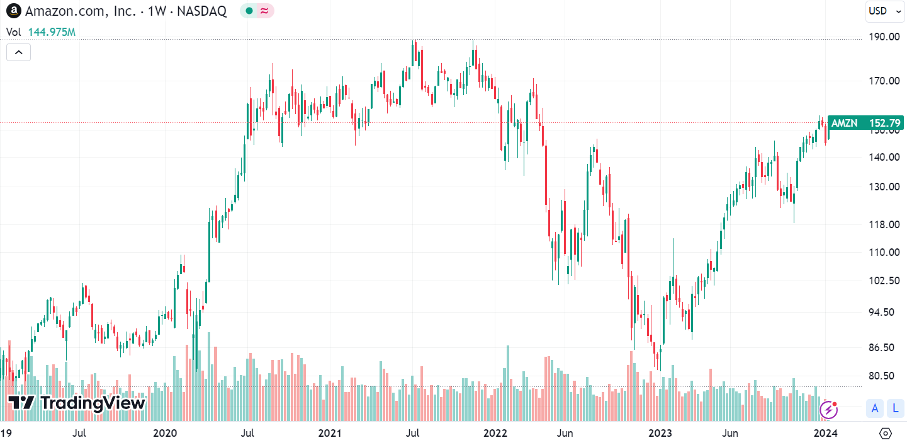

Performance of Amazon.com, Inc. stock over 5 years. Source: tradingview.com

Amazon

Amazon, primarily known for its e-commerce prowess, is also a leader in cloud computing. Amazon Web Services (AWS) showcases impressive revenue growth and stable operating margins, solidifying its market position. However, it's Amazon's $4 billion investment in Anthropic, an OpenAI competitor, that's most exciting. This partnership, leveraging AWS's infrastructure and Amazon's inferencing chips, positions Amazon at the forefront of the AI revolution.

The Strategic Alliance with Anthropic

Amazon's investment in Anthropic is more than a financial venture; it's a strategic move into the AI arena. By using AWS as its primary cloud provider, Anthropic benefits from Amazon's robust infrastructure, while Amazon gains a valuable ally in the AI field. This partnership is poised to catalyse growth within AWS, especially in generative AI models.

Amazon's Attractive Valuation

Currently, Amazon's price-to-sales (P/S) ratio stands at 2.7, a steal compared to its historical average and its tech peers. This valuation presents a lucrative opportunity for investors to buy into a leading company at a bargain price, especially given the growing importance of AI and cloud computing in IT budgets.

The 2024 Outlook: Amazon’s Potential for Growth

As AI continues to integrate into mainstream IT, 2024 might just be the start of an era where AI budgets swell. Amazon, with its strong foothold in AI and cloud computing, is perfectly positioned to capitalize on these market dynamics. The combination of a favourable historical trend, a strategic focus on AI, and an attractive valuation makes Amazon a compelling choice for investors in 2024. [2]

Conclusion

In summary, the tech stock market, particularly Amazon, is on a trajectory that combines historical resilience with cutting-edge innovation in AI and cloud computing. For investors, 2024 represents a unique opportunity to participate in the growth of a company that is not only redefining its industry but also trading at an attractively low valuation. The time seems ripe to consider Amazon as a key player in your investment portfolio. [3]

* Past performance is no guarantee of future results.

[1,2,3] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.