Chaos versus clean structures

My primary focus is the US dollar. This market has proven itself to me over the long term and offers me room to execute trades in the time zone when I am most active. This is very important to determine when choosing a market, because each market only sees its strongest moves during a particular trading session. The highest order volumes in the AUD/NZD/JPY market are executed during the Asian session. Conversely, EUR/GBP/CHF during the London session and finally USD/CAD/XAU during the New York trading session.

Based on certain aspects, AUD/USD seemed to me to be the most attractive market yesterday. This market is creating clean and clear market structures, so I decided to wait for the US session and enter the trade after creating a trading setup.

Technical and fundamental analysis

As far as fundamental analysis is concerned, yesterday - 29 June, at 14:30, the data regarding the Gross Domestic Product (GDP) of the USA was published. This data turned out much better than initially expected. As I mentioned earlier, the technicals in the AUD/USD market were very favourable. Bearish structures have been forming there for quite some time, and Price Flow also played in my favour.

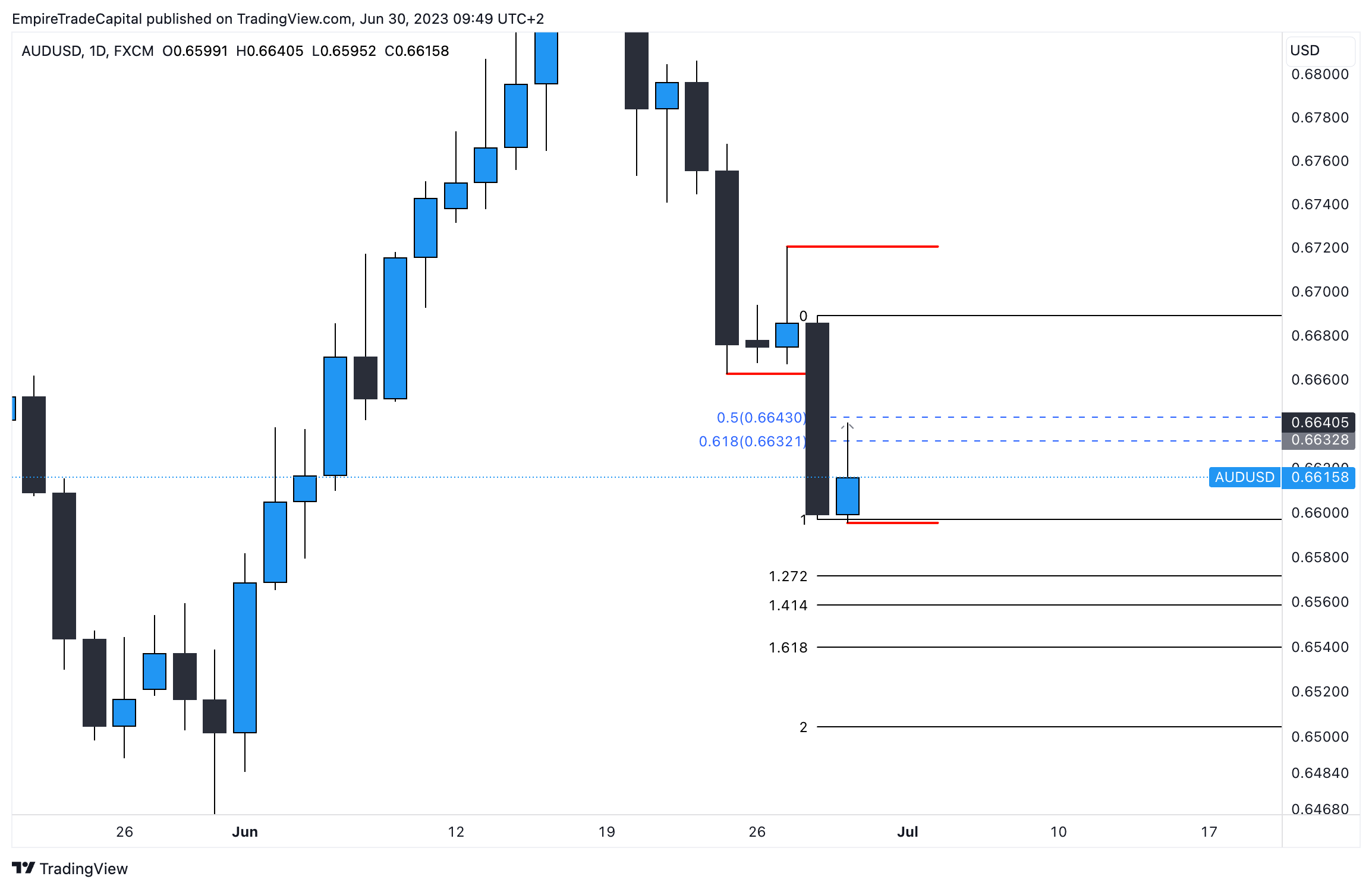

In terms of the daily time frame (TF), on Tuesday we could see a liquidity spike reflected by the candle formation called Pin bar, and then on Wednesday, there was a strong selling pressure. In the context of the bearish structures on the lower TF, this presented an ideal selling opportunity for me. To determine the Area of Interest (AoI) I used the Fibonacci retracement zone tool. Based on this, I identified where the 0.5 and 0.618 levels were located and moved to the lower TF.

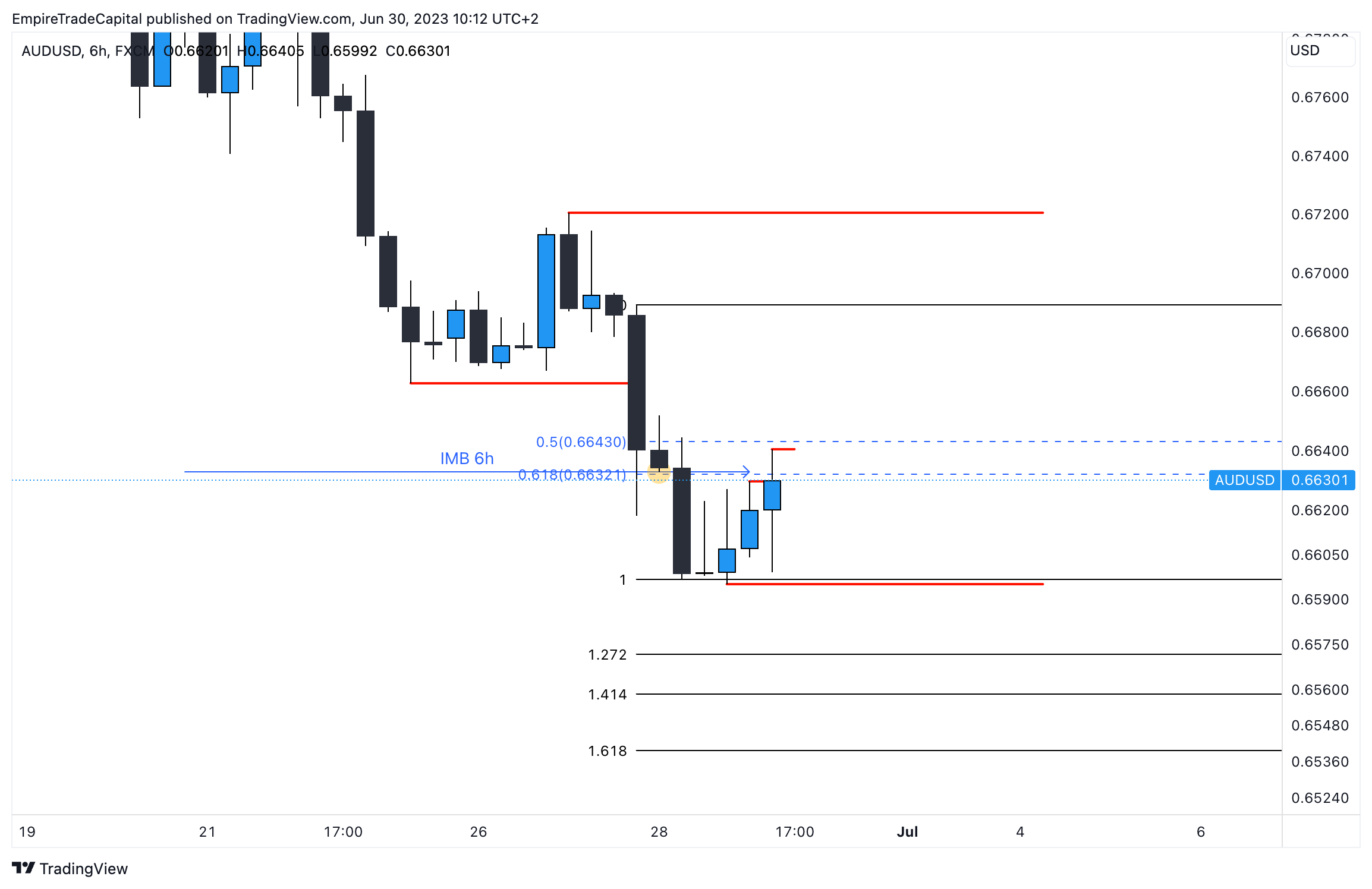

I noticed that on the six-hour timeframe (6h TF), the wick of the candle filled the bearish Imbalance zone, which corresponded with the Fibonacci zones from the daily TF. This warranted me to move to an even lower timeframe and wait there for the transformation structures to form.

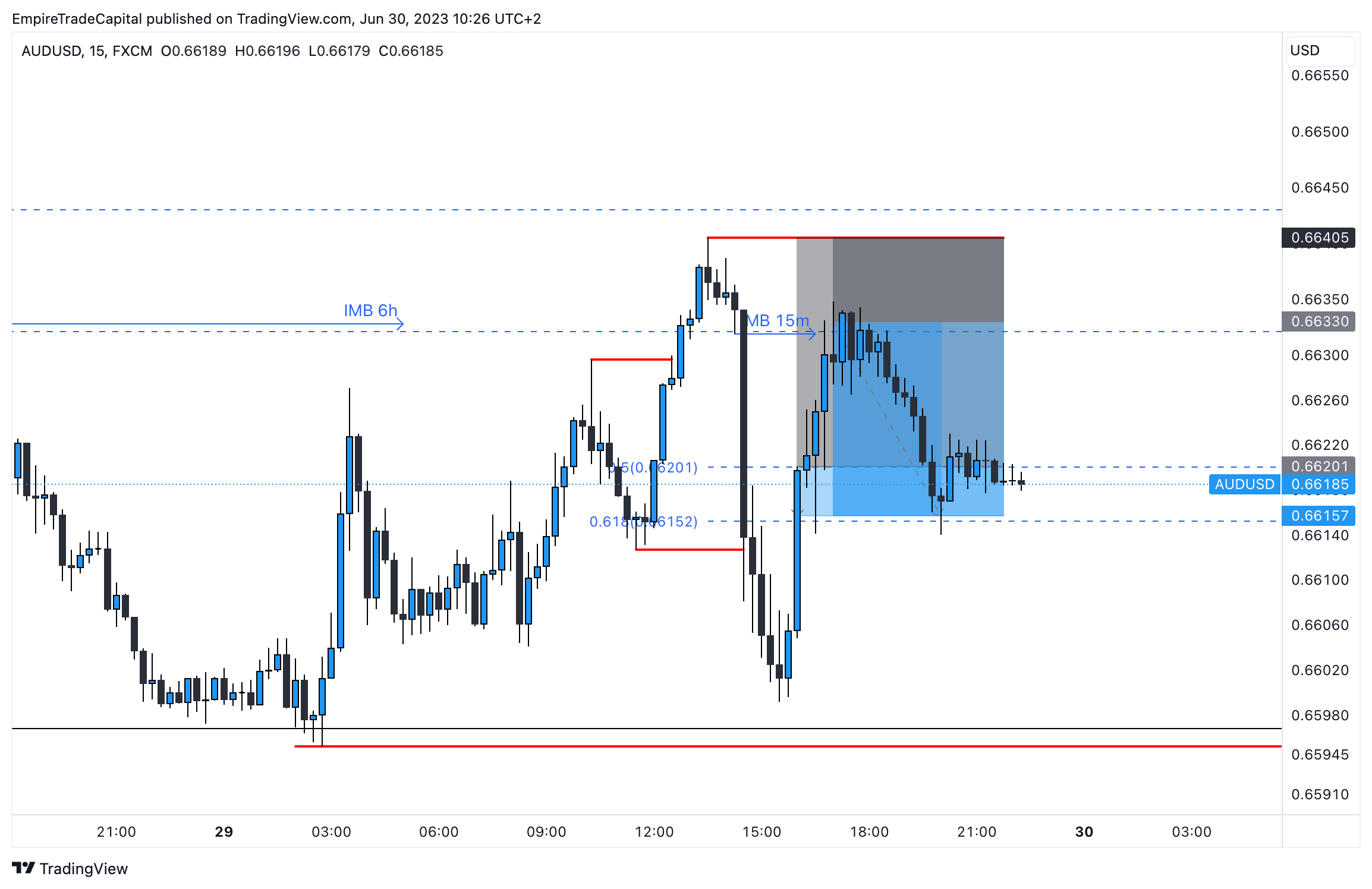

This exact transformation occurred on the fifteen-minute (15m) TF. At this point, I placed a pending order due to the more decent Risk Reward Ratio (RRR.)

Given the bullish move at 15m, as can be seen, it was too impulsive, and so I entered with a much lower volume position than I had originally planned.

The price continued to rise, and I place second smaller sell position at the last possible stop from which the price had the potential to fall (the last Imbalance zone.) This decline later occurred, and I closed the trade with a profit of 2.3R.