Analysis before the announcement

Unless there is some random manual intervention in the market, price moves based on regular algorithmic patterns, targeting two basic things. Liquidity and Market Imbalance. Therefore, before CPI, I focused on these two aspects and assessed that the price had been rising sharply for quite some time, thereby creating Imbalance zones, and leaving behind zones of relatively equal lows below which liquidity was accumulating. Based on this, I was expecting a sharp decline. Since I don't trade on days like this until the announcement due to the increased risk, I was waiting to see what would happen.

Imbalance zones on daily and 4h time frame

Relative Equal Lows on 1h time frame

CPI statement and figures

As far as the numbers are concerned, inflation in the US fell from the initial level of 3.4 to 3.1. Such a decline represents a positive factor for the US dollar and an opportunity for the Fed to reassess its view on monetary policy. Given that inflation is falling, there is unlikely to be a need to raise interest rates further. This could have a positive impact on US stocks going forward.

As I have already mentioned, the US dollar sees this decline as positive, and this has also contributed to the fact that stock indices have finally fallen as expected.

Trade of the day

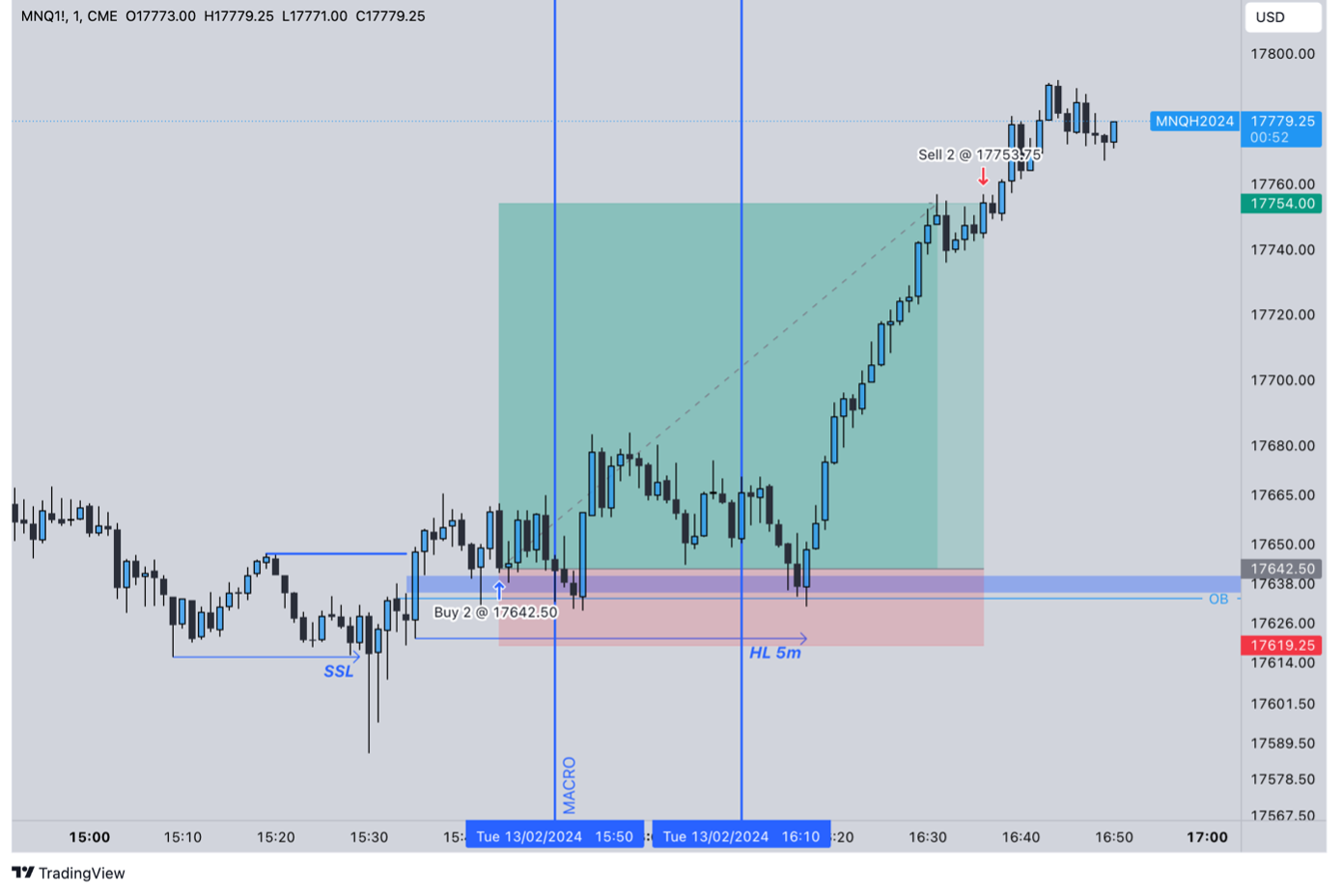

After the price drop on the US100 index, I had a buy trade lined up as the longer-term trend is bullish, and such a short-term spike is purely to collect liquidity from traders and investors who bought early. *

The announcement occurred at 2:30 pm, so I waited until the situation calmed down and I could enter with less risk. Any trade must be done within the price model of the trader in question, but time should not be forgotten. 15:50 to 16:10 is the time when the orders of the big players are accumulating in the market while the technical parameters that make up my trading model have been found, and so I enter a buy position. In this trade, I ended up with a profit of 5R (Risk Reward Ratio).

Trade on US100, one-minute time frame

* Past performance is no guarantee of future results.