[1] Link to 5-year performance: https://tradingeconomics.com/dxy:cur

Looking only at the yield is not professional, and in the current conditions, opening trade would be a psychological mistake called Fear of Missing Out (FOMO.) I plan to wait for a correction that will allow me to enter the market at a more favourable price with reasonable risk. [1]

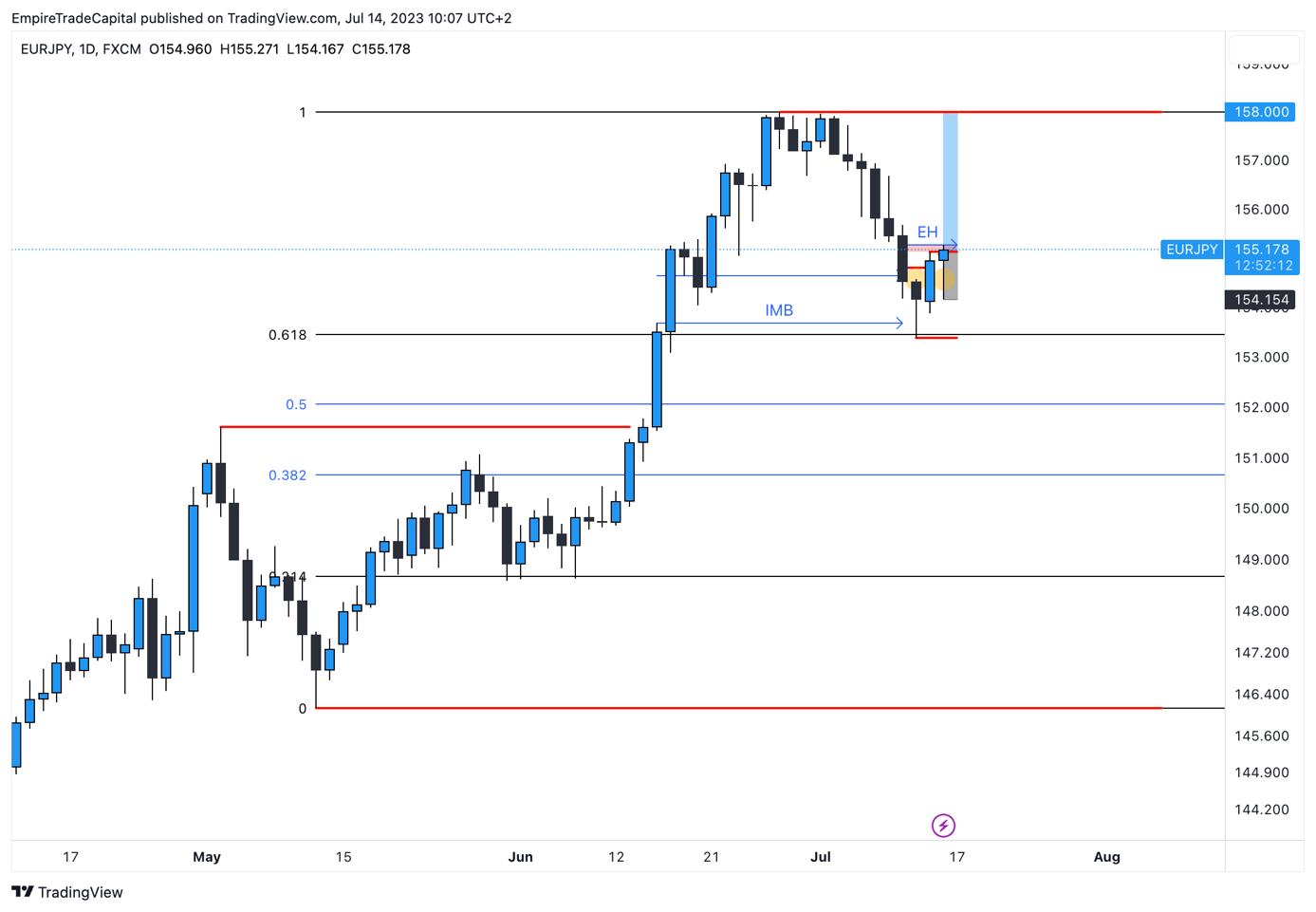

Since my watchlist consists of the Japanese Yen (JPYBasket) and gold in addition to the US Dollar (DXY). Gold is also still heavily influenced by news regarding inflation, so I decided to analyse the Japanese Yen more closely. From my perspective, the most attractive market seemed to be EURJPY. The Euro has been relatively strong after the weakening of the USD, and the JPY was showing signs indicating an end to the correction.

In terms of technical analysis, a long-term uptrend can be seen. At the top of this move, several equal highs have formed which may serve as a future lure for the price due to the liquidity above this zone (Stop Loss orders of those who wanted to trade against the trend and sold.)[2] The price is currently at the Fibonacci level of 0.618 and has also managed to fill the daily Imbalance zone candle. Yesterday, July 13, the price closed as a bullish candle, and today it immediately balanced this move. Based on these aspects, I moved to lower time frames and looked for the best possible entry into a buy position.

* Past performance is no guarantee of future results

[1,2] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.