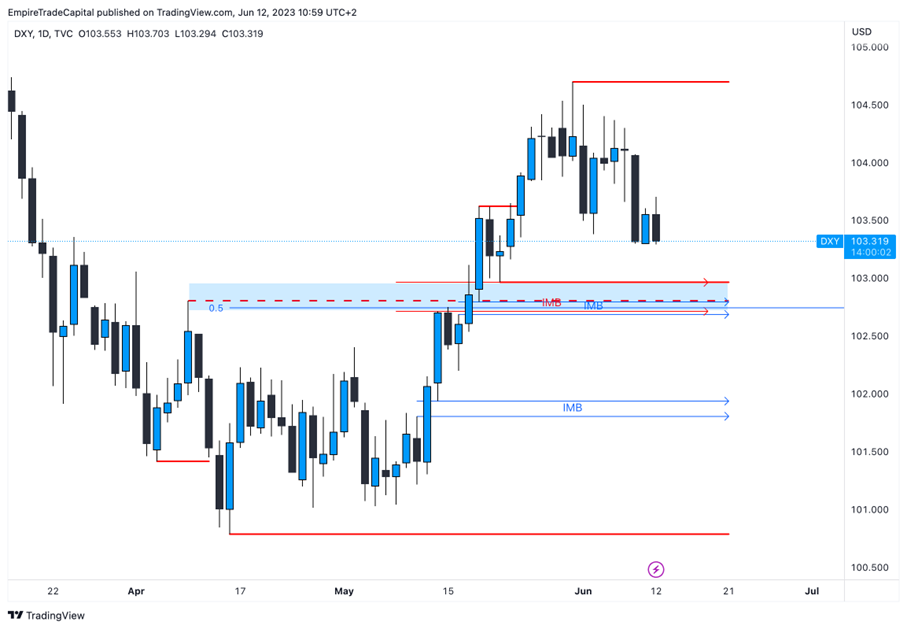

May was marked by strong buying pressure for the USD. As the market moves in patterns, it is always possible to expect some correction after a strong move upwards/downwards. In this case, on the daily time frame, 8.6, the USD formed a sharp bearish candle, one of many signals indicating the start of a correction. [1] I see the daily Imbalance (IMB) zones around the 102.7 and 101.8 levels as potential correction targets. The 102.7 zone has several factors that may make it very attractive in price. In addition to being a daily IMB zone, it is also a weekly one. Further, it is important to mention that these zones correspond with the previous structure point and the 0.5 Fibonacci (FIB) level.

In terms of the four-hour time frame, the price is still in a bullish structure, but the 0.214 Fibonacci level has already been tested. Subsequently, I observed a corrective Price Flow, indicating a lack of buyers' strength.

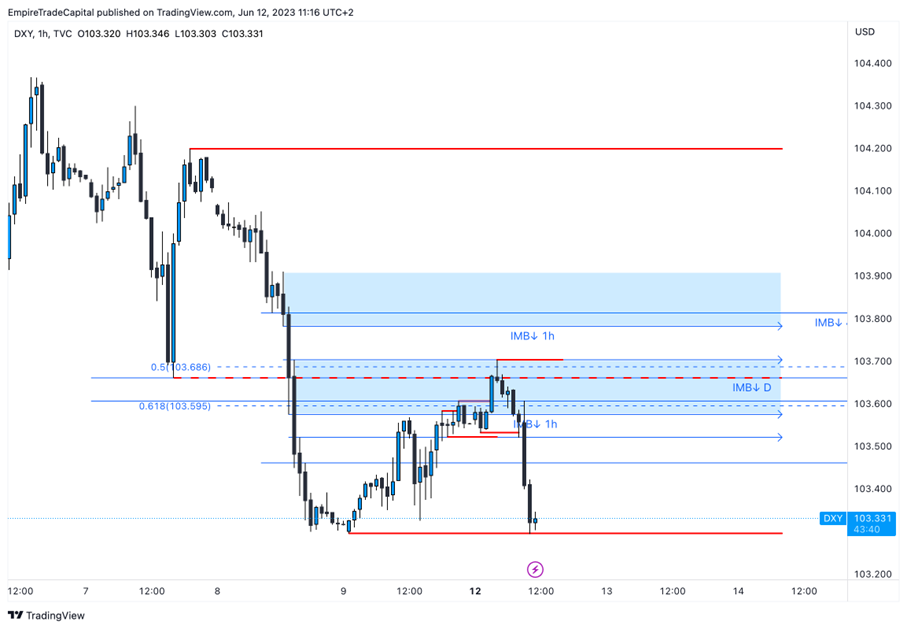

Shifting my analysis to the one-hour time frame, I noticed that the price "broke" on the bearish structure, which, along with other factors, is a very favourable situation for me, as I would like to sell the USD. I have identified several Areas of Interest (AoI,) in which I would like to execute my trade. The most attractive was the one around the 103.6 level. There were the daily and one-hour IMB zones and the 0.5/0.618 FIB levels.

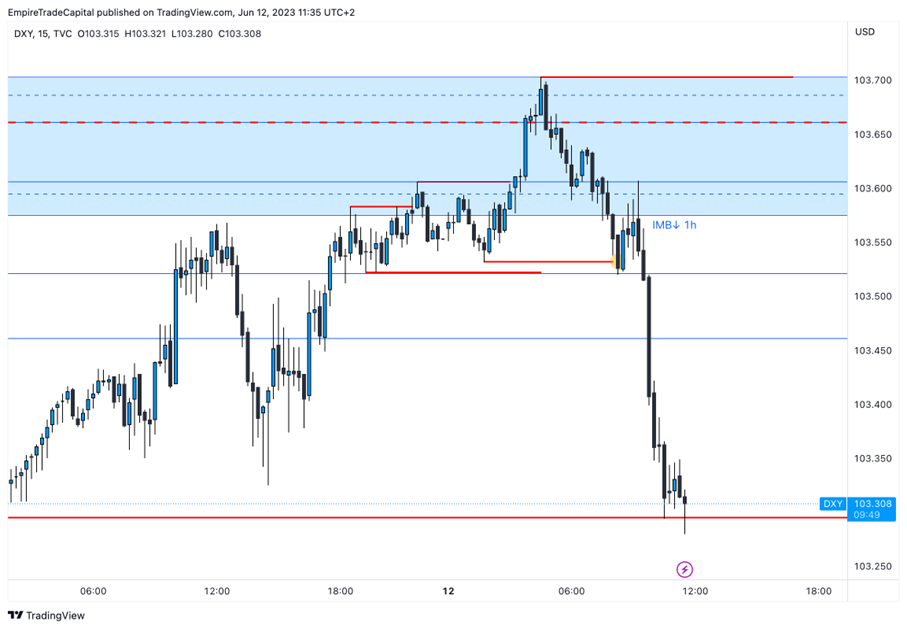

I always wait for confirmation of movement on smaller time frames before entering a trade. With this setup, I waited for the price to "break" below the Higher High (HH) on the 15m chart. This did happen, and I had an open path to enter the trade at that point. EUR/USD is the market that correlates the most with DXY. So, I opened the EUR/USD chart and placed a pending order at the 0.5 FIB level because of the more lucrative Risk Reward Ratio - the ratio of risk to the potential reward.

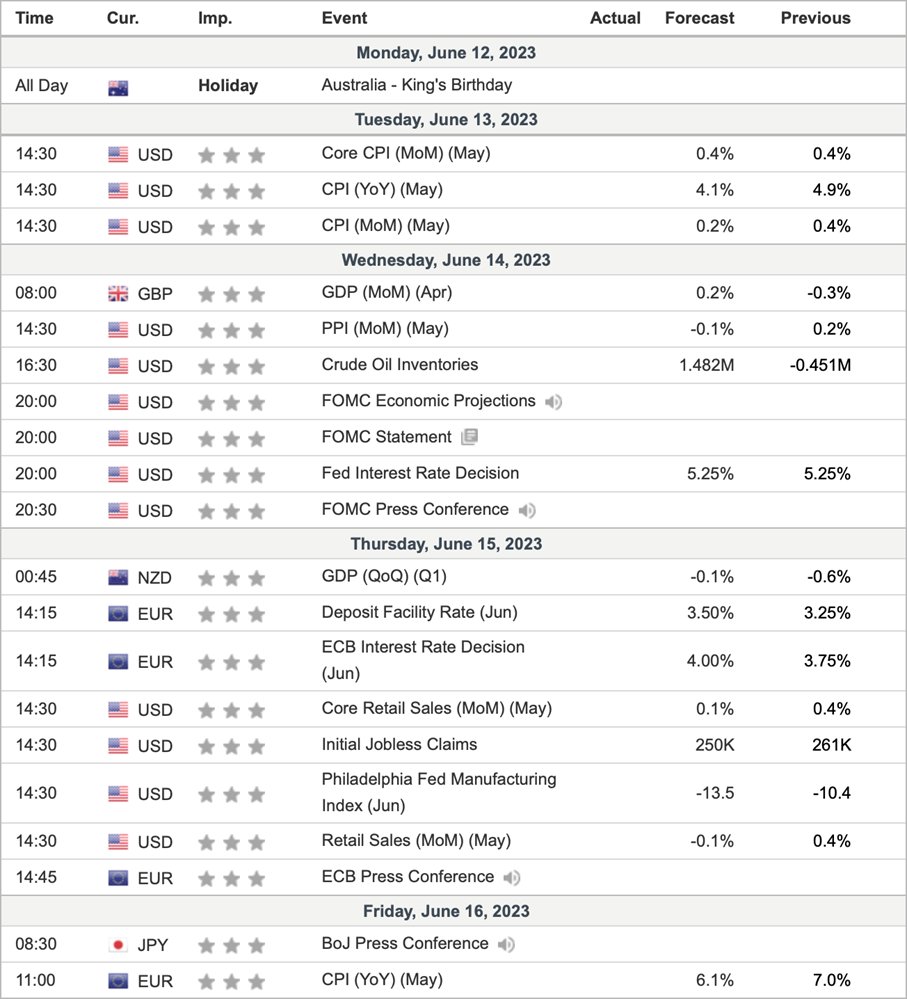

I closed the trade with a profit of 3.7 RRR/7%. I didn't want to leave this trade open longer than today as there will be many macroeconomic reports announced, which will sharply increase volatility in the markets.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.