Dollar on the other hand is being under pressure because of the inflation and financial aid to Ukraine. I also noticed some hints that FED decided to slowly stop with raising interest rates, which would be rather negative for the currency. So based on the fundamental analysis I have made, the pair should keep falling. At least, that’s what I thought. After following the chart for some time, and making a technical analysis on it, I realised that we hit the strong support level and that the value of pair is already returning back to the point it was before the news. Because of this support/resistance line, I think that I should approach the trade very carefully. That’s why I decided to open position on long, and it already proved to be the smart decision, as I have small profit there. However, we need to keep in mind that I opened smaller position, as I approached the trade safely and did not let myself get caught up in emotions.

After fundamental and technical analysis, I have concluded that right now at this moment, USDJPY is a good opportunity for long position.[2] But if we are looking for long term trade, I could say that the charts will be in a downtrend, as they are for some time now. [3] As I mentioned before, if FED will stop to raise the interest rates, and the decision of Bank of Japan will prove to be good, there is no reason for the price of USDJPY to fall.

Whenever we open a trade, we should not forget that USD is under more pressure, however the new governor can prove to be a failure, so the chart can make a quick U-turn, as it did today and also on the 3rd of February, when the price spiked. *

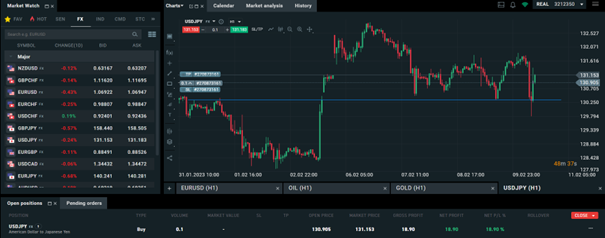

As seen below, I have opened the position at the price of 130.905 and while I was writing this diary, the price already hit 131.153, giving me a nice profit of 18.90%.

[1,2,3] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results may differ materially from those expressed or implied in any forward-looking statements.

* Past performance is no guarantee of future results. Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

Link to 5 year chart: https://www.investing.com/currencies/usd-jpy