However, the Reserve Bank of Australia has decided to change its view on monetary policy. Interest rates were left at 4.10%, and the hawkish stance was tempered by this. Based on these fundamentals, I have been looking to sell the Australian dollar as lower-than-expected interest rates weaken the currency. I was most interested in the GBP/AUD pair.

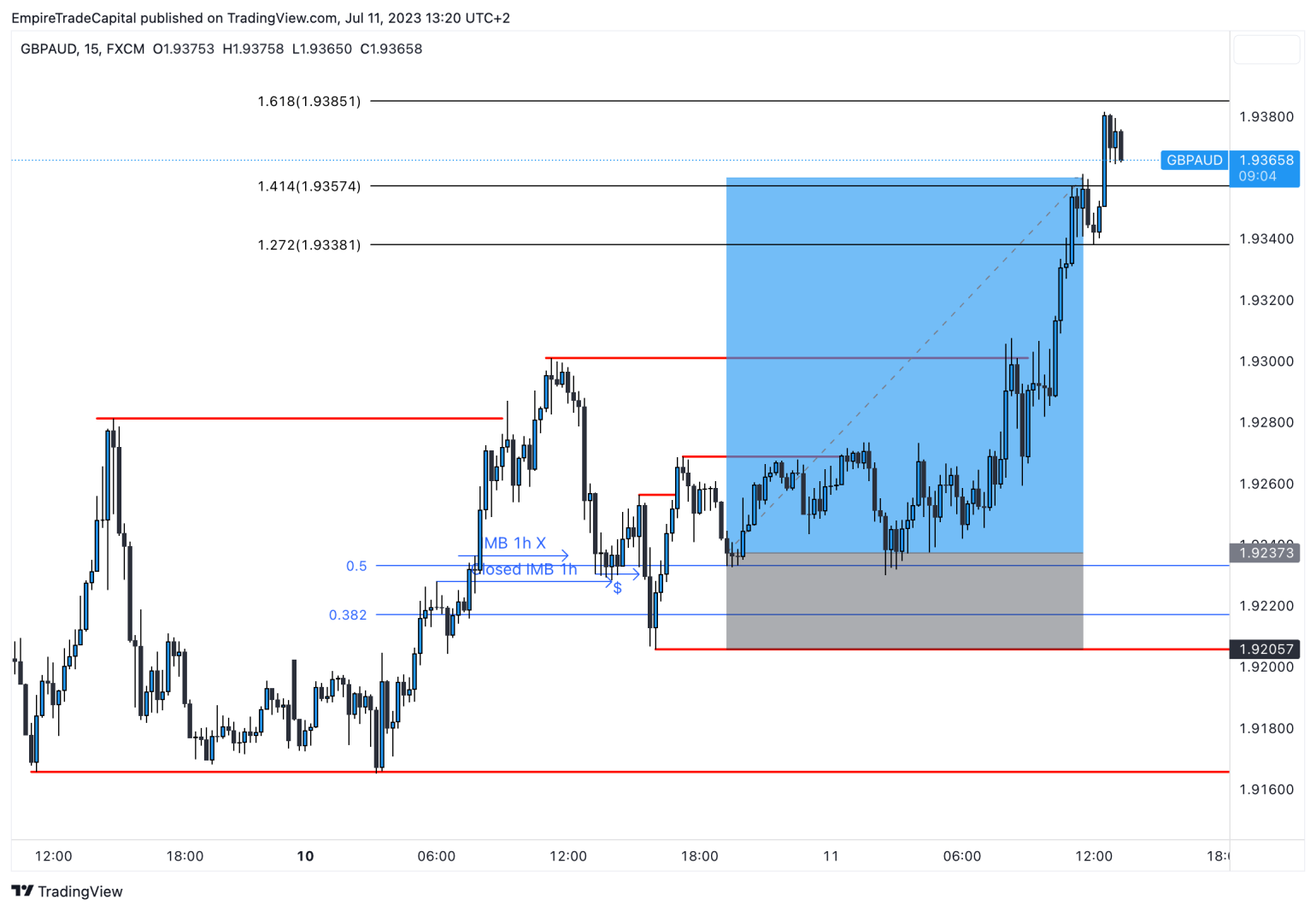

On all major timeframes (Weekly, Daily, 4h, 1h,) this market is in bullish structures. Complementing this with macroeconomic factors, that was a clear buy signal for me. Having established the potential zones where it would be advantageous to execute the trade, I was just waiting for the entry set-up to be formed. As you can see on the chart above, the price closed the one-hour Imbalance zone (1h IMB) but started to move in a bullish corrective tendency. This showed me that influential buyers are not yet involved in the market, and I must wait. The price subsequently dropped lower, but then even stronger buying pressure came in and I knew at this point that if a correction came, I would be able to buy following all criteria. So it happened, and I entered the market at 1.92374. I set my stop loss order below the higher low -> 1.92058. Take Profit was set at the price of 1.93600. The latter corresponded with the Fibonacci level of 1.414. This trade ended with a profit of 3.88R (Risk Reward Ratio.) *

* Past performance is no guarantee of future results.

[1] Link to 5-year performance: https://tradingeconomics.com/gbpaud:cur