Article said that Moderna announced that clinical trial data indicates its revised COVID-19 vaccine is likely to be effective against the highly-mutated BA.2.86 subvariant of the coronavirus, which has raised concerns about a potential resurgence of infections. The vaccine demonstrated an 8.7-fold increase in neutralizing antibodies against BA.2.86 in human trials, a variant closely monitored by health organizations. Moderna's infectious diseases head, Jacqueline Miller, stated that this news should encourage people to consider fall booster shots and provide reassurance to regulators. The U.S. Food and Drug Administration is expected to approve the updated vaccine later this month or in early October. Other vaccine manufacturers like Pfizer and Novavax have also developed shots targeting specific subvariants of the virus, indicating an ongoing effort to combat evolving strains. Despite the spread of BA.2.86, global vaccination and immunity from prior infections are expected to mitigate the risk of severe disease and death associated with this variant.

Among good news about Moderna, there were also reports about Pfizer and Novavax. It is said that the drug manufacturer based in Massachusetts, along with competing COVID-19 vaccine producers Novavax and Pfizer in partnership with German firm BioNTech, have developed modified versions of their vaccines specifically targeted at the XBB.1.5 subvariant.

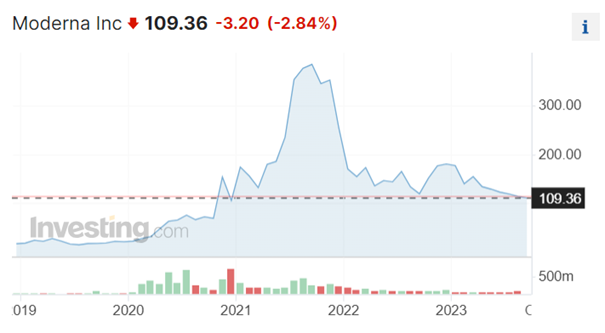

Because of the fact that Moderna stocks had the biggest surge during the pandemic, I have decided to check them again, if there is a possibility of new Covid pandemic around the world. Pre-pandemic price of stocks was at around 20 USD, while the highest point it reached was in 2021, when the price peaked to 450 USD.* This marks an unbelievable growth of more than 2,000%.* In hopes that stock can make a similar performance, I have decided to invest smaller amount and wait. [1]

Movement of Moderna stocks in the last five years. (Source: Investing) *

* Past performance is no guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.