Article on Reuters wrote that millions of commuters in Germany were impacted today as airports, bus and train stations across the country came to a standstill in one of the largest walkouts in decades. The strikes, which were called by the Verdi trade union and railway and transport union EVG, lasted for 24 hours and were the latest in a series of industrial actions that have hit major European economies. Higher food and energy prices have caused living standards to drop, prompting workers to press for higher wages to counter the effects of inflation, which reached 9.3% in February. That percentage is anything else but nice, as I could also feel higher inflation when I went grocery shopping or used some service. Germany, which was heavily dependent on Russia for gas before the conflict in Ukraine, has been particularly affected by rising prices as it searched for new energy sources, leading to inflation rates that have exceeded the eurozone average in recent months. Frankfurt and Munich airports suspended flights, and Deutsche Bahn cancelled long-distance rail services. Striking workers, wearing high-visibility jackets, blew horns and whistles through an empty Munich train station. Bad news for Germany for sure, and probably for the whole Eurozone, since they are the biggest and strongest economy on that continent. The idea popped up, that for sure EURUSD forex pair was affected by this.

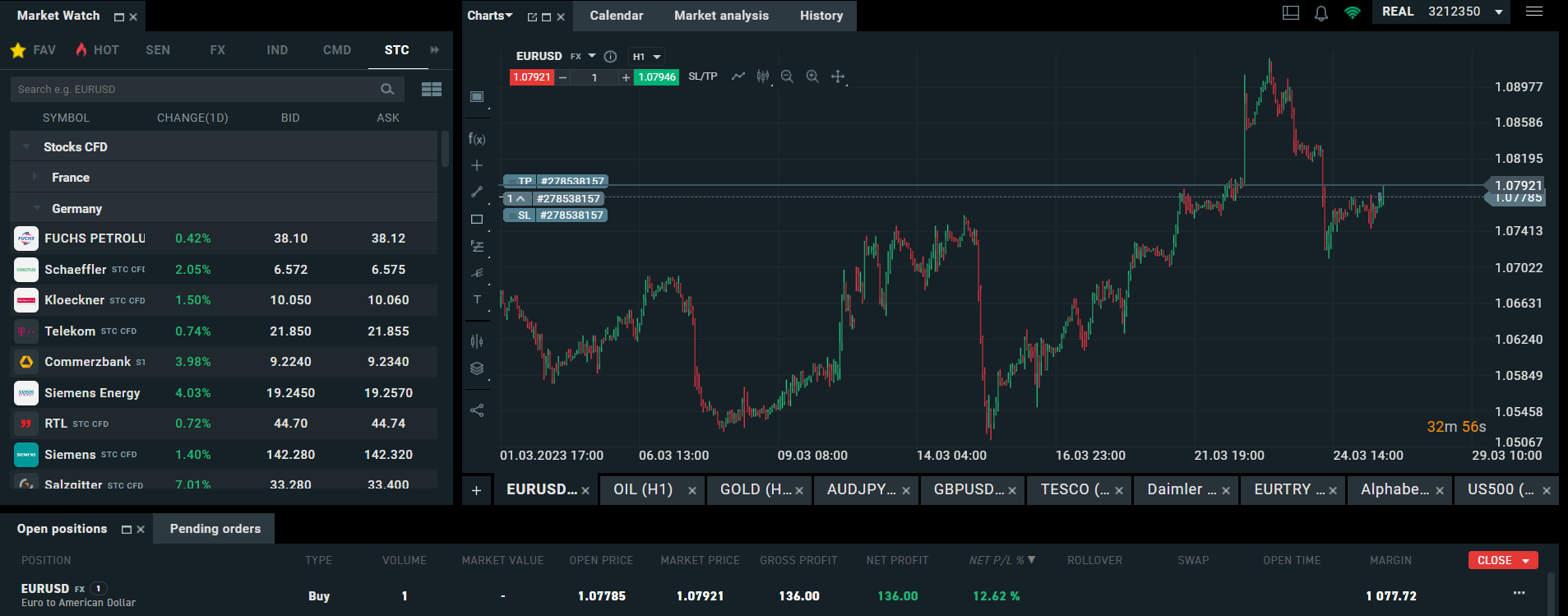

I opened the chart on Zetano platform, and it was no surprise that there has been correction – value or euro fell in comparison with US dollar. The fall was not that bad as it seems on the first glance, because it dropped for a little less than 2%. On Thursday, the exchange rate was 1 EUR for 1,0927 USD, while current exchange rate is 1,0770.* Quickly after the drop, this pair found support level and overturned the trend. It seems, that again the pair is forming a sort of a channel, the same way as it did before the drop. It is hard to say if only the news about protests caused the fall, or it was in mix with the news that ECB might not raise interest rates for some time now or at least slower them. In positive hopes that euro will keep getting stronger compared to USD I decided to open a position on long.

*

* Past performance is no guarantee of future results.

Link to a 5-year chart: https://www.investing.com/currencies/eur-usd