The results turned out worse than expected. Although unemployment fell to an expected 3.6% NFP saw a drop to 209K from the original 306K. The US dollar (DXY) immediately reacted to this and fell by almost 1%. *

Based on these fundamentals, which I have supplemented with technical analysis, my trading outlook for this week is clear. I want to sell the U.S. dollar, and that means buying opportunities on my favourite Forex pair EUR/USD, for example.1

Technical analysis

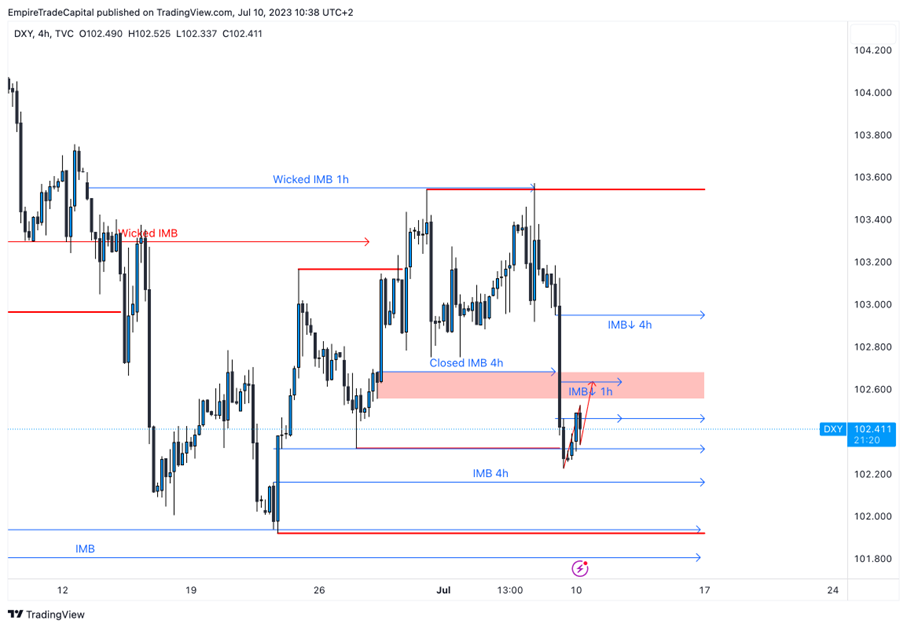

Since fundamental analysis alone is insufficient to form a complete trading idea, I looked at the DXY from a technical perspective today and found an attractive opportunity [2].

The next potential stop for the price is 102.634. That corresponds with the one-hour Imbalance (1h IMB) zone. If the price comes to this level, I will be watching closely to see how it behaves there. In case of strong bullish signs, I will not sell and wait for higher potential levels such as 102.950. As for Price flow, we can observe a bullish/corrective one for now.*

Chart 1 DXY - 4h TF*

Chart 2 DXY - 1h TF[1]*

[1] Link to 5-year performance: https://tradingeconomics.com/dxy:cur

* Past performance is no guarantee of future results

[1,2,3] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.