Top stocks

{{ items[slide]['title']}}

Taiwan Semiconductor Manufacturing

Tesla Inc

Meta Platforms Inc.

Berkshire Hathaway Inc

NVIDIA Corporation

Amazon.com Inc

Alphabet Inc Class C

Saudi Aramco

Microsoft Corporation

Apple Inc

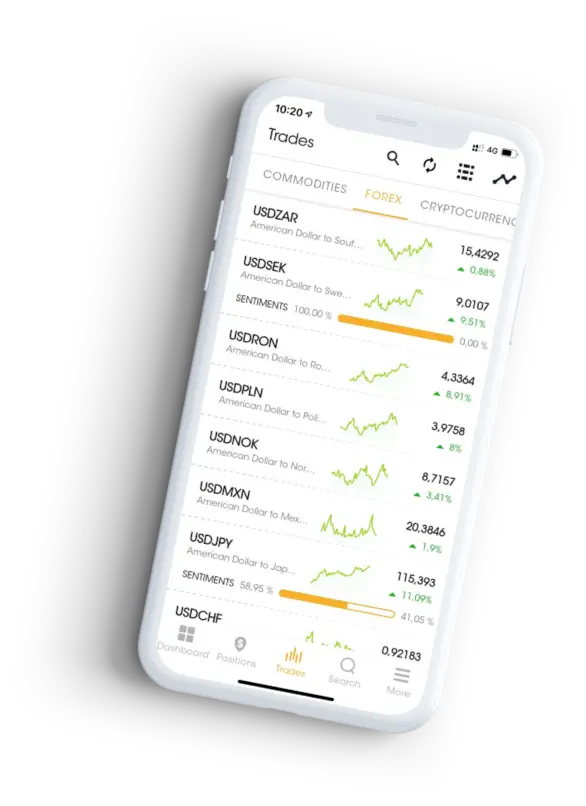

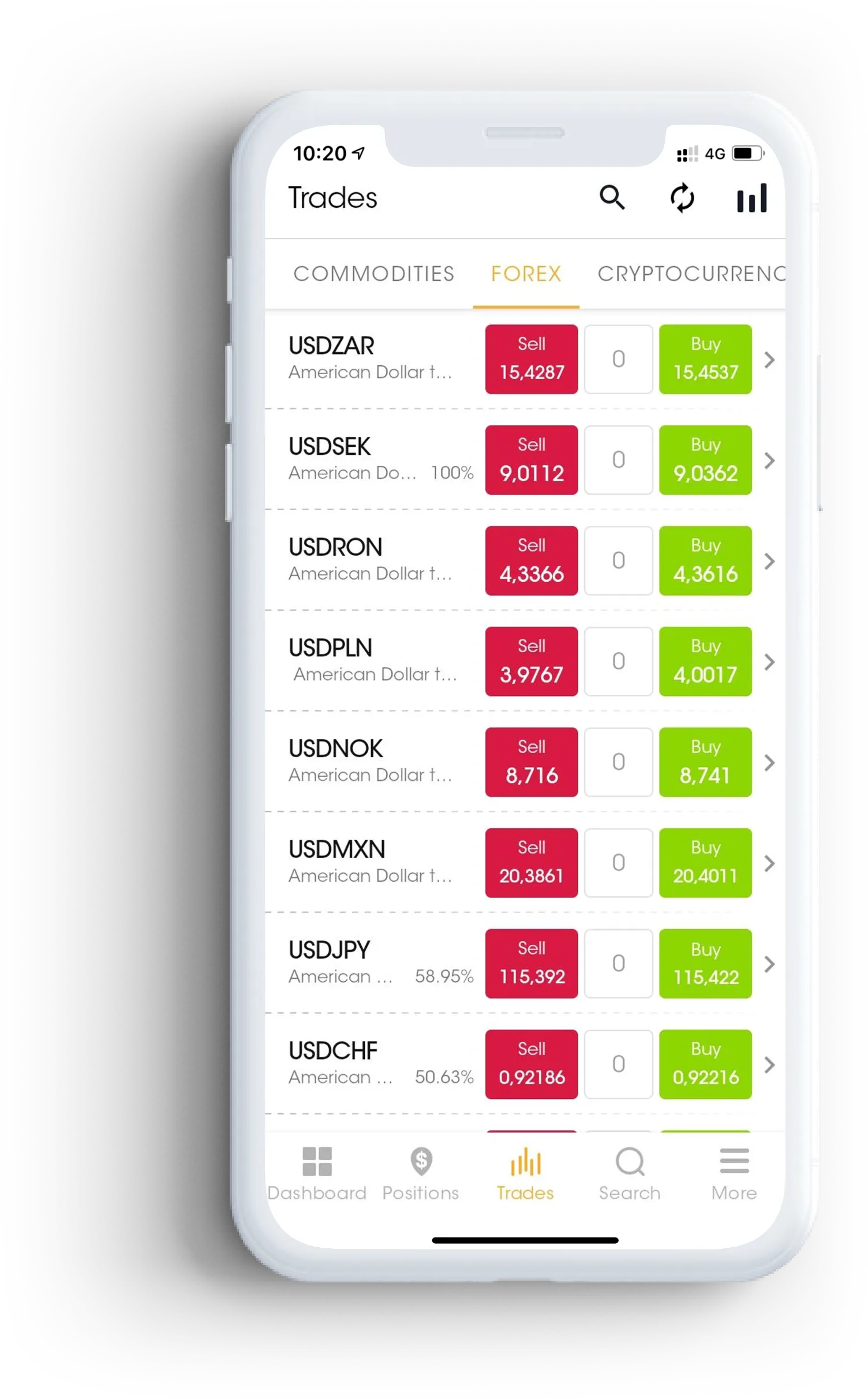

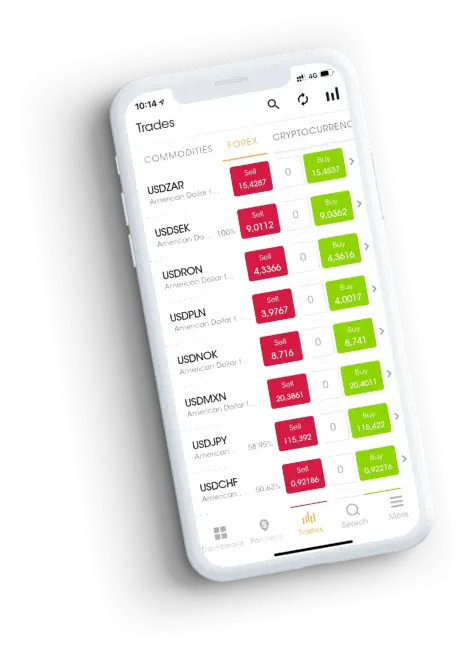

The mobile world phenomenon through

the eyes of ZETANO broker

Trading the future means trading without compromise

Why open account?

Why us?

European license

Regulation

Free account

Local costumer support

Risk management function

Cyber security standards

Diversity of financial instruments

Awarded

Education

Open trading account in seconds

Are you new to trading?

Visit our Academy

Are you an experienced investor?

Become a VIP client

Start investing today!

With us you can start trading even with small capital.

Opening an account is simple and fast, therefore anyone can handle it

Sign up, send money to your trading account, upload the necessary documents, and you can start trading.

Start trading today so you can watch your investment portfolio grow tomorrow.

Risk Warning: Buying or selling financial instruments may result in the loss of some or all of your invested funds. You should carefully consider whether investment advice suits your needs, your financial resources and your personal circumstances. Read the Risk Disclosure and Notice, Privacy Policy, and Terms and Conditions.

Do you need help with registration?

Our professional team is always ready to help you start investing and take the first step towards financial independence.

We accept

Where can you find us?

Choose one of the branches, where you can consult our experts about news from the world of investments and trading options that suit your preferences.

{{ current }}

Limassol, Cyprus

Wonderinterest Trading Ltd 176 Makariou III Avenue, Paschalis Court, Office 201, 3027, Limassol, Cyprus